Posts

Hiring Tips: How to Prevent a Bad Hire

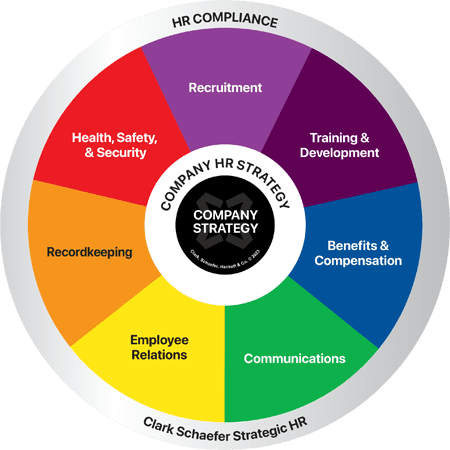

Last Updatedin HR Strategy, Recruitment, Training & Development Question of the Week

Why Overcoming Unconscious Bias Is Key to Your Organization’s Success

Last Updatedin HR Strategy Question of the Week

Employee Engagement Ideas To Fit Any Budget

Last Updatedin Employee Relations Question of the Week

What Should I Use To Measure Recruitment Performance?

Last Updatedin Recruitment Question of the Week

Federal Employment Poster Requirements for On-Site and Remote Workers

Last Updatedin HR Compliance, Recordkeeping Question of the Week

Are Social Media Background Checks Legal?

Last Updatedin Recruitment Question of the Week

What To Do If a Background Check Results in a Rejection of Hire

Last Updatedin Recruitment Question of the Week

ADA Accommodations and Attendance

Last Updatedin HR Compliance Question of the Week

Understanding The Options Like a PEO, ASO, or HRO to Grow Your Human Resources Function

Last Updatedin HR Strategy Question of the Week

Employee Training: Online Vs. In-Person

Last Updatedin Training & Development Question of the Week

Paying Interns – Primary Beneficiary Test

Last Updatedin Benefits & Compensation Question of the Week

Are Wellness Program Incentives Taxable?

Last Updatedin Benefits & Compensation Question of the Week

What Does In Loco Parentis Mean In Regards to an FMLA Claim?

Last Updatedin HR Compliance Question of the Week

Emergency Response Plans: Preparing for Emergencies & Natural Disasters

Last Updatedin Health, Safety & Security Question of the Week

Why Should We Provide Civility Training at Our Company?

Last Updatedin HR Strategy Question of the Week

What Does It Mean To Be a Partially Exempt Industry Under OSHA?

Last Updatedin Health, Safety & Security Question of the Week

Avoid Penalties: Maintain a Legal Hiring Process

Last Updatedin Recordkeeping Question of the Week

What Is the Business World Doing to Support the Sandwich Generation?

Last Updatedin HR Strategy Question of the Week

How Can HR Impact the Bottom Line?

Last Updatedin HR Strategy Question of the Week

English-Only Policies in the Workplace

Last Updatedin Communications Question of the Week

Writing a Winning Employee Newsletter

Last Updatedin Communications Question of the Week

Attendance Point System Policy

Last Updatedin Employee Relations Question of the Week

Contact Us

Clark Schaefer Strategic HR (CSSHR)

10856 Reed Hartman Hwy

Suite 225

Cincinnati, OH 45242

Clark Schaefer Strategic HR (CSSHR) is recognized by SHRM to offer Professional Development Credits (PDCs) for SHRM-CP® or SHRM-SCP® recertification activities.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice about their particular situation and relevant jurisdiction. This website contains links to other third-party websites. These links are only for the convenience of the reader, user or browser; Clark Schaefer Strategic HR (CSSHR) does not recommend or endorse the contents of the third-party sites.