HR Compliance Questions of the Week

Is it Important to Use Consensual Relationship Agreements?

Last Updatedin Employee Relations, HR Compliance

How To Conduct a Workplace Accident Investigation

Last Updatedin Health, Safety & Security, HR Compliance

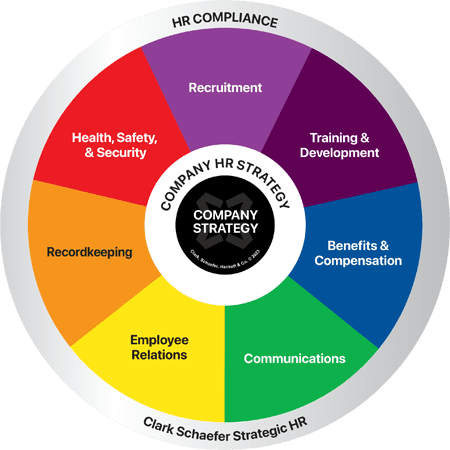

What Are The Top 5 Commonly Missed Records In Employee Files?

Last Updatedin HR Compliance

For human resources professionals, there are many things you simply have to get right in order to protect your organization, and recordkeeping is one of them. Employee files, also known as personnel files, are a key component of the recordkeeping process for any organization. They provide a written history of each employee’s tenure with an organization including important information such as pay increases, promotions, disciplinary action, etc. Additionally, there are several documents that are required to maintain HR compliance at the federal level in the United States. For example, check out the U.S. Department of Labor’s reference for federally required new employee documentation.

These documents and comprehensive files can be maintained physically on paper or digitally ideally using a defined data storage strategy supported by an organization’s IT department. Many employers utilize the U.S. Department of Labor’s digital data storage guidelines when developing a digital data storage strategy.

5 Most Commonly Missed Records in Employee Files

Out of all the documents required to be maintained in employee files, below are the five most commonly missed. Do you have these records in your employee files?

1. Pre-Hire Documents

Pre-hire documents include the employee’s resume and application, the signed offer letter or employment contract, a signed handbook acknowledgment, tax withholding forms, a signed code of conduct, and emergency contact information.

2. Wage and Salary Information

Wage and salary information include any increases given (e.g., merit, cost-of-living adjustment (COLA), or promotion-related increases), bonus information, and significant changes to an employee’s position relative to the Fair Labor Standards Act (FLSA) exemption status.

3. Performance Reviews

The performance review documentation that should be stored within an employee file may be a 30 or 90-day review or a signed copy of the employee’s quarterly/semi-annual/annual review. Follow your organization’s timeline and policies for performance reviews and ensure these are added to all employee files.

4. Disciplinary Action

Disciplinary action forms and performance improvement plans (PIPs) are key to maintaining a comprehensive and documented narrative for the employee’s performance. If for any reason an employee is terminated, it can provide information with the potential to protect an organization from litigation. Learn more about at-will employment termination risks and how to reduce your liability.

5. Training and Development

Training and Development documentation can include training plans or checklists, verification of federal or state-required training, as well as the employee’s attained certifications, degrees, and licenses.

How to Properly Store Employee Records

It’s important to understand and follow proper employee record storage procedures. For example, did you know it is recommended that the I-9 Form be stored separately from the employee files? According to the U.S. Citizenship and Immigration Services, I-9 Forms should be stored in a way that best fits your organization, yet is easily available for USCIS inspection. As a result, best practice leads to storing I-9s separately from other files.

Although there is some leeway with employee record storage, best practice is to maintain the following five separate sets of files:

- Employee/Personnel

- Medical

- Confidential – Non-Medical

- Form I-9

- Candidates Not Hired

For more on what should be included in each of these files, read our article explaining how to organize employee records and remain compliant.

Regardless of the storage process you choose, be sure to audit your employee files to ensure compliance. We recommend creating an employee file document list for new hires and ongoing employment by reviewing federal and state requirements, record retention guidelines (which can vary for federal contractors), benefit documentation, and organization-specific documents. This will provide a starting point to validate that your organization’s current files aren’t missing any key forms.

Thank you to Mary Mitchell, MBA, SPHR, SHRM-SCP, CHRS, Senior HR Business Advisor for contributing to this Emerging Issues in HR.

Keep the guesswork out of how to store and maintain your employee files. Strategic HR has a handy Recordkeeping Desktop Reference that outlines the employee documents you should have on file and how long to keep them. Learn more about our HR Compliance & Recordkeeping Services or Contact Us for help!

What Are the Latest ACA Reporting Changes and Deadlines?

Last Updatedin HR Compliance

HR Question:

I know it’s almost time for the next ACA reporting period. What changes do I need to be aware of for the 2023 tax year?

HR Answer:

You’re right – the ACA (or Affordable Care Act) reporting season is right around the corner! While there are no major changes to the ACA forms and codes for the 2023 tax year, there are some items or updates to be aware of as we head into 2023. If you’re unsure whether you need to report, check out our article on ACA reporting requirements.

Paper Filing Deadlines

The employee distribution deadline for the 1095-C forms is March 4, 2024. In previous years, employers could file their 1095-C and 1094-C forms in paper format to the IRS by mail as long as they did not exceed 250 forms in total. Moving forward to this coming reporting year, the IRS is requiring all employers with more than 10 forms to report through electronic methods. This could be either directly through the IRS’s system or through a third-party provider set up to send to the IRS’s system (such as many HRIS providers). Any corrected forms would also be required to be submitted electronically. If there are less than 10 forms, the paper filing deadline will be on February 28, 2024.

If the employer’s coverage is not affordable under one of the safe harbors and a full-time employee is approved for a premium tax credit for marketplace coverage, the employer may be subject to an employer shared responsibility payment under Section 4980H(a) or Section 4980H(b).

E-Filing Deadlines

The deadline for e-Filing 1095-C and 1094-C forms to the IRS is April 1, 2024 (since March 31st falls on a Sunday). Keep in mind that there could be additional ACA state reporting requirements for your organization with differing deadlines. The states to pay special attention to are California, New Jersey, Massachusetts, Rhode Island, and the District of Columbia.

Be aware of the full list of form types that are required to be sent to the IRS electronically based on the total number of forms submitted.

• Forms 1042–S

• 1094-series

• 1095–B and 1095–C

• 1097-BTC

• 1098, 1098-C, 1098–E, 1098-Q, and 1098–T

• All 1099 series

• Forms 3921 and 3922

• 5498-series

• 8027

• W–2G

• Forms W–2 (Wage and Tax Statement)

• U.S. Territory Forms 499R–2/W–2PR (Withholding Statement (Puerto Rico)

• U.S. Territory Form W–2VI (Virgin Islands Wage and Tax Statement)

There have always been fines attached to late filing with all of these forms. However, the amount has increased to $290 per W-2 from $250 (even if they are mailed in paper format and should have been sent electronically).

Updated Affordability Percentage and Penalties

For the 2023 tax year, the affordability percentage – the maximum amount of an employee’s pay that can be spent on “Employee Only” coverage in order to be considered “affordable” by ACA – decreased from 9.61% to 9.12%. Although there are no major changes to the ACA forms and codes for the 2023 tax year, the IRS has updated the ACA affordability percentage to 9.12%.

Additionally, the IRS has declared that the penalty under Section 4980H(a) will increase to $2,880 or $240 per month, and the penalty under Section 4980H(b) will increase to $4,320 or $360 per month. With these increasing costs associated with noncompliance, it’s important for employers to carefully assess their group health plan offerings to make sure they’re aligning with ACA best practices. It is also essential to ensure that these plans provide comprehensive coverage to full-time employees, including at least one affordable self-only option that meets minimum value benefit requirements.

Thank you to Mary Mitchell, MBA, SPHR, SHRM-SCP, Certified Healthcare Reform Specialist, for contributing to this week’s HR Question of the Week.

Whether you’re new or experienced when it comes to ACA reporting, it can be a confusing process. Clark Schaefer Strategic HR are here to help! If you are unsure if your company should be reporting for ACA, we can help assess your employee calculations to determine if it is needed. We also have the ability to check your employee data for compliance and electronically file your company’s ACA forms with the IRS on your behalf. Contact us for your ACA reporting needs.

At-Will Employment Termination Risks

Last Updatedin HR Compliance

HR Question:

We’ve got a team member who just isn’t working out. The problem is we haven’t taken all of the right steps in documenting the issues, but we’re an at-will employer – can’t we just terminate anyway? What are the risks of at-will employment termination?

HR Answer:

The term “Employment At-Will” is a familiar one for most employees and companies. So, what exactly does this term mean? Conceptually, it means either the employer or the employee is free to end the employment relationship at any time, with or without notice or cause. A majority of employers throughout the United States establish at-will relationships with their employees, either as the result of the law, existing policy, or a combination of both. However, does this mean it gives an employer the freedom from risk should they decide to terminate an employee on the basis of the at-will employment relationship? Not exactly.

At-Will Termination Risks

As a best practice, an employer should not completely rely on an employee’s at-will status to defend a termination decision. Even though good cause is not needed to end an at-will employment relationship, most employers typically have a valid reason for termination, such as continual poor performance.

Prior to terminating an employee under at-will circumstances, keep in mind that it’s not uncommon to receive a retaliation claim, a discrimination claim, or a similar action.

Additional justification is expected when putting an individual out of their job, whether it has to do with the person’s performance, violation of company policy, or another workplace issue entirely. Providing justification can reduce the time and resources related to managing a termination.

Protect Yourself with the Basics

It’s important to establish best practices on the front end, and consistently follow them to reduce your at-will termination risks. Ideally, no one should be surprised by a termination notice. Considering all of the dynamics that are usually in play when it comes to terminations, the best way to approach an at-will termination is to follow solidified HR practices from the beginning. As the age-old HR saying goes “document, document, document!”

Having clearly defined procedures, training, practices, and consistent follow-through allows an employer to navigate the waters of risk when it comes to at-will terminations.

If issues have not been documented, there are a few things to consider:

- If progressive disciplinary action is listed in the employee handbook, it’s important to follow it consistently.

- Before taking steps toward termination, consider the approach. Are these actions in line with the company’s culture? Are they representative of the company’s values?

- It is okay (encouraged, even) for HR to press the “pause” button on the situation and require the necessary documentation before authorizing a termination.

Steps to Reduce Employer Liability and Risks

There are easily established processes and policies that can be implemented to reduce liability and risk throughout the employee’s life cycle. We recommend that employers:

- Use disclaimers in the new-hire process (offer letters and new-hire orientation) and require signed acknowledgments.

- Clearly outline employment expectations.

- Implement a progressive discipline policy.

- Adopt a grievance procedure.

- Train supervisors on how to properly document disciplinary actions.

- Include human resources in the disciplinary process.

- Review situations carefully and seek legal guidance prior to making adverse employment decisions.

Culture and Morale Matter

It’s important to consider all of the issues that go along with terminating someone who is employed on an at-will basis. Parting ways with an employee, justified or not, can have an impact on your culture and morale. Handling terminations in a manner that is consistent, ethical, and shows dignity and respect for the individual involved plays a critical role in how your remaining employees view the company’s leadership.

There is always a risk in termination. It is always good practice to involve your attorney before pulling the final trigger to ensure support if a legal issue may arise.

Thank you to Julie Schroer, SHRM-CP, for contributing to this edition of our HR Question of the Week!

Let the HR experts at Clark Schaefer Strategic HR help you navigate the employment law minefield. Check out our HR Compliance and Recordkeeping page to learn more, or contact us directly!

What Do I Do Now That I-9 Flexibilities Are Ending?

Last Updatedin HR Compliance

HR Question:

In July 2023, the Department of US Citizenship and Immigration Services eliminated the Form I-9 flexibilities put into place due to COVID-19. Recently, I understand they are again allowing the remote review of I-9 documents. Is this accurate?

HR Answer:

Yes, you’re correct – the US Citizenship and Immigration Services (USCIS) confirmed that the temporary flexibilities for verifying documents for I-9 forms expired on July 31, 2023. Any remote team members hired during the COVID-19 pandemic (on or after March 20, 2020) whose I-9 documents were verified remotely, had to have their documents physically inspected. That verification was required to be completed by August 30, 2023.

While we all scrambled to update these documents, USCIS came out with additional guidance on July 25, 2023, that provided an alternative procedure for Form I-9. The Notice indicated that employers who meet the following four (4) requirements may choose an alternative procedure in lieu of physically examining Form I-9 documentation that had been examined remotely under the COVID-19 flexibilities.

To qualify for the alternative procedure, an employer must have:

- Performed remote examination of an employee’s documents between March 20, 2020, and July 31, 2023;

- Been enrolled in E-Verify at the time they completed the Form I-9 for that employee;

- Created a case in E-Verify for that employee (except for re-verification); and

- Be currently enrolled in and continue to participate in E-Verify.

Employers who do not meet all four requirements must perform an in-person physical examination of documents by August 30, 2023.

The USCIS provides details on the alternative procedure and examples of properly completed forms.

New Form and Additional Flexibilities

Although many HR professionals celebrated the alternative procedure that was provided, we had more to celebrate when the flexibility was extended. In August 2023, the USCIS allowed permanent remote examination of employees’ Form I-9 documents IF they are enrolled in the E-Verify program. For more guidance, refer to the detailed alternative procedure.

Finally, the department did issue a new I-9 form in August 2023. The form dated “10/19/2019” can continue to be used through October 31, 2023, but beginning November 1, 2023, only the new Form I-9 dated “08/01/2023” can be used.

What if an Employee Refuses?

If an employee is unwilling or unable to provide documentation for physical confirmation or remotely if you qualify, that employee is subject to termination. Employers cannot retain an employee who has not provided documentation for the I-9 form, including presenting their documents for physical inspection. Organizations that retain an employee who is not authorized to work in the United States, or who have not reviewed documentation in person, are subject to hefty fines by the USCIS.

Remember, I-9 forms should be kept in a separate file from the employee’s personnel file, and make sure you retain the updated I-9 forms. For additional information, be sure to check out USCIS’s FAQ for Employers.

Special thank you to Patti Dunham, MBA, MA, SPHR, SHRM-SCP, Director of HR Solutions and Sheryl Fleming, MA, SHRM-SCP, HR Business Advisor for contributing to this edition of our HR Question of the Week!

I-9 forms and other employment verification processes are important to get right – otherwise, you might be subject to costly fines and legal fees. Let our HR experts lend a hand! Learn more about how we can support your compliance efforts by visiting our HR Compliance and Recordkeeping page or by contacting us today.

How To Limit Liability At Your Company Party

Last Updatedin HR Compliance

HR Question:

We’re looking forward to hosting our company holiday party to celebrate our accomplishments this year. While we want this to be a fun celebration, we also want it to be responsible. How can we limit liability at the company party, especially if we’re considering serving alcohol?

HR Answer:

The holidays are here, and to many, that means it is time for holiday parties. While holiday events are a great time to bring your team together and increase engagement, there are potential risks to keep in mind as an employer. As you plan your event, below is a list of best practices to consider that may help to limit potential liability:

- If it is truly a social event for your team, do not require attendance. Remind staff that attendance is not required but voluntary. This may help to limit liability with a potential harassment claim because the event is voluntary and not in the course and scope of employment.

- To further support the non-work nature of the event, hold the event off-site and outside of regular business hours. Many organizations also allow employees to bring a guest thereby underscoring the non-work component.

- Set expectations around respectful behavior and encourage employees to drink responsibly. Remind employees that company policies, including harassment and other conduct policies, apply at the event.

- Determine if alcohol will be offered. Company leaders will need to determine if the company holiday party is the right environment for alcohol. There are multiple factors to consider, including the age range of your workforce, how the timing of the party fits with employees’ work schedules, past history, and the location of the party. If you have employees under the age of 21, your company will need to assess how you will handle this potential liability. If you have employees attending the party before their shift, that is another issue you will need to address.

How to handle alcoholic beverages at the party

If you decide to provide alcoholic beverages, there are a number of considerations you can make that may help limit potential liability at your company party. Here are some good practices to consider:

- Provide food and non-alcoholic beverages at the event, both for safety reasons and so those who choose not to drink alcohol know you’ve considered them and feel included.

- Offer a cash bar where employees purchase alcohol. This can reduce the likelihood of a claim that the employer provided alcohol directly to employees. It is also likely to reduce consumption.

- Provide employees with a set number of drink tickets so that each attendee is limited in the number of alcoholic drinks they will be served.

- Plan for how employees who have been drinking will get home. This may involve providing taxis or public transit options at no cost to the employees, arranging for group transportation, or encouraging employees to designate a driver at the beginning of the event.

- Even if you don’t plan to provide a taxi service, don’t think twice about calling and paying for one if an intoxicated employee has no way home other than driving themselves. To facilitate this, someone from management can be designated to stay until the end and maintain their own sobriety to ensure that everyone gets home safely.

- Have a plan to ensure that no minors or visibly intoxicated attendees are served alcohol. If possible, hire professional servers (or hold the event at a staffed facility) who will, as part of their job, politely refuse to serve anyone whom they perceive has had enough to drink.

How to handle cannabis at the event

Consider the potential use of cannabis at the party. With the legalization of cannabis in many states, employers also need to be prepared to deal with this new potential concern at holiday events. Employees may believe it is appropriate to bring this state-legal drug (in some instances) to the party, but, marijuana remains illegal under federal law.

It may be appropriate to remind staff of your drug-free workplace policy (if applicable) which prohibits consumption in the workplace and at company-sponsored events. If you wish to avoid consumption at your party, clearly communicate the policy to employees before the event. The Society for Human Resource Management (SHRM) offers these additional suggestions regarding cannabis at holiday parties.

While these steps will not eliminate all the risks, they may help to reduce liability and help your employees celebrate the year and their achievements safely and responsibly. For more suggestions on how to limit liability at your company party, SHRM provides these tips to reduce liability while celebrating the season.

Thank you to Patti Dunham, MBA, MA, SPHR, SHRM-SCP, Director of HR Solutions, and our HR Support Center for contributing to this HR Question of the Week.

It’s important to celebrate company success, but don’t throw caution to the wind in the process. Our Strategic HR Business Advisors are prepared to help you celebrate and protect your business and your employees. We can help you to reduce your potential liability by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance and Recordkeeping page to learn more about how we can help or contact us for immediate support.

How Can I Prevent Unethical Behavior On My Team?

Last Updatedin HR Compliance

HR Question:

I’m a new supervisor. Now that I have oversight of my team, I know it’s my responsibility to keep an eye out for unethical behavior. But what does that behavior look like? How can I prevent unethical conduct on my team?

HR Answer:

Ethics in the workplace can be a broad and, at times, intangible concept. At its root, unethical business practices include any behavior that violates the law, such as theft or violence, but can also include areas that are broader and more nebulous. According to The HR Digest, the five most common examples of unethical behaviors are:

- Employee theft. In 2012, one out of every forty employees was caught stealing from the workplace.

- Misusing company time. This may include an employee who spends the entire morning placing orders on Cyber Monday or a co-worker who clocks in for an employee who shows up late.

- Verbal abuse. This can include bullying co-workers or subordinates or harassing employees.

- Lying in the workplace. An example could be a sales employee who tells customers that a defective product has a flawless reliability record.

- Taking credit for someone else’s work. This could be an employee who takes credit for a co-worker’s idea for a process improvement and receives a bonus for a job well done.

Is Unethical Behavior Really That Common?

Studies suggest that unethical behavior is something that all managers must confront at some point in their careers. To illustrate this point, in HR Ethical Dilemmas by the Society for Human Resources Management, 30% of surveyed U.S. employees said they felt pressured to compromise their workplace’s ethics, a 14% increase from three years earlier. Almost half of those employees surveyed said they observed misconduct that violated their organization’s ethics standards.

The risks of unethical behavior in business can be devastating. For instance, bad corporate behavior can lead to the loss of valued employees and can discourage new recruits from applying. Employees want to work for a company that has values that align with their own personal values. They’re even willing to take a pay cut for it, as evidenced by MetLife’s recent study that found 89% of employees are willing to trade some of their salary (an average of a 21% pay cut) to work at a company whose values match their own.

But the impact isn’t just felt internally, as customers’ decisions can also be impacted by unethical behavior. According to Accenture’s Global Consumer Pulse Research, 62% of consumers consider a company’s ethical values and authenticity before making their purchasing decisions. Finally, unethical behavior can carry with it legal risk, resulting in fines, penalties, and even incarceration.

How Can a Company Prevent Unethical Behavior?

Companies can take steps to prevent unethical and unlawful behavior. This includes the following steps:

- Establish a Code of Conduct. Business leaders, including HR, must establish clear statements that define a company’s values, principles, and conduct.

- Train every employee on the company’s values, principles, and code of conduct. Training should be done in a way that helps each employee to see how their work and behavior support these principles.

- Establish a means for reporting unethical behavior. One of the most effective ways of enabling employees to report workplace ethics violations is to establish a 24/7 hotline that allows employees to report concerns anonymously and without retaliation. Those staffing the hotline should be a third-party, or employees who are removed from operational management. Concerns should be reported directly and confidentially to a senior executive or, in some cases, to a designated Board member.

- Include a question on business ethics in your employee engagement surveys. If employees respond less than favorably to this question, find out why through focus groups or department meetings.

- Share your Code of Conduct with your clients and suppliers. Let them know the company will abide by the Code while working with them. Provide them with a means to share feedback on any concerns regarding business ethics while working with the company.

As a supervisor, it goes without saying that your team is likely to emulate the behavior that you model. Therefore, it is important that you uphold the company’s values and Code of Conduct in your own behavior and ensure that your team members receive the appropriate training and understand the ethical standards they are expected to maintain.

Special thanks to Terry Wilson, SHRM, SPHR-SCP for writing this edition of our HR Question of the Week!

Have a new supervisor on your team? Put them on the road to success by signing them up for our Supervisor Training Series! Visit our Training and Development page to learn how we can help your management team to get off to the right start.

Do Our Remote, Out-of-State Employees Qualify for FMLA?

Last Updatedin HR Compliance

HR Question:

Our company has employees located in Ohio who all qualify for the protections covered under the Family Medical Leave Act (FMLA), but we also have employees working remotely in other states. Do our remote, out-of-state employees qualify for our FMLA policy?

HR Answer:

Great question. Even if the employees don’t fall within the 75-mile radius that the FMLA takes into account when counting employees towards the requirements, employers are still required to provide FMLA benefits to their employees who work remotely and out-of-state.

Why Does FMLA Compliance Matter?

What happens if those same benefits aren’t extended properly? Well, a lack of FMLA compliance can result in impressive fines. For example, not completing the notice can cost several hundred dollars alone, not to mention the millions in fines that can result from a mishandled claim or wrongful termination, such as the situation this Massachusetts company found itself in.

Even before the COVID-19 pandemic struck, some companies were beginning to branch out of their home states and hire individuals with the necessary talent, but not necessarily the ideal location. Many of these organizations were pioneering the process, working through the requirements and laws as they could. Now that remote work has become such a staple in the business community, it’s easier for any organization to run into this issue, as it’s often the case that many remote employees may be the first or only employee in a particular state.

How to Determine if Remote Employees Qualify for FMLA

There have been no changes to what is defined as “covered employers” as defined by the Department of Labor (DOL), as a “covered employer may be a private-sector employer (with 50+ employees within a 75-mile radius in 20 or more workweeks in the current or previous calendar year), a public agency, or a school.” Employers that fall under this category are required to provide FMLA benefits and protections to eligible employees while also complying with additional responsibilities required under the FMLA.

An eligible employee is one who:

- Works for a covered employer,

- Has worked for the employer for at least 12 months as of the date the FMLA leave is to start,

- Has at least 1,250 hours of service for the employer during the 12-month period immediately before the date the FMLA leave is to start (a different hours of service requirement applies to airline flight crew employees), and

- Works at a location where the employer employs at least 50 employees within 75 miles of that worksite as of the date when the employee gives notice of the need for leave.

So why does this rule extend to those employees who fall outside of the 75-mile radius and the 50+ employee count? It’s because the DOL determines their FMLA status based on the office or location that delivers their assignments or that they report to. The purpose of this is to protect the employees’ jobs should they have the need to focus on their own or their family’s health.

If you assume that you don’t have to meet FMLA guidelines for a remote employee, be sure to double-check the Department of Labor’s regulations, as well as your own internal reporting system, before skipping this important requirement.

Special thanks to Alisa Fedders, MA, SPHR, and Samantha Kelly for contributing to this edition of our HR Question of the Week!

FMLA, ADA, and other labor laws can be difficult to understand – let alone enforce. That’s where Strategic HR has you covered. We bring years of experience and know-how to the table. We can assist you with your tough compliance issues and help you sleep more soundly at night. Visit our HR Compliance & Recordkeeping page to learn more.

Who Has to Submit OSHA Form 300A?

Last Updatedin Health, Safety & Security, HR Compliance, Recordkeeping

Can I Ask if My Employees Are Vaccinated?

Last Updatedin Health, Safety & Security, HR Compliance, Recordkeeping

Can we ask if our employees are vaccinated? Isn’t this a HIPAA violation or an illegal inquiry under the ADA or somehow confidential information?

Employers can ask for proof of vaccination unless there is a state or local law or order to the contrary.*

When an employer is requesting or reviewing medical information in its capacity as an employer, as it would be when asking about an employee’s vaccination status, it is considered to be an employment record. In such cases, HIPAA would not apply to the employer. The Americans with Disabilities Act (ADA) will govern the collection and storage of this information.

The Equal Employment Opportunity Commission (EEOC), which enforces the ADA, has stated that asking about vaccination is not a disability-related inquiry, though it could turn into one if you ask follow-up questions about why the employee is not vaccinated. Asking a yes or no question, or requesting to see the employee’s vaccination card, does not violate any federal laws or require proof that the inquiry is job-related.

Finally, just because employees think that something is or should be private or confidential doesn’t mean they can’t be required to share it with their employer. Social Security numbers, birth dates, and home addresses are all pieces of information an employee may not want to advertise, but sharing is necessary and required for work. Vaccination status is similar. However, all of this information, once gathered, should not be shared by the employer with third parties, except on a need-to-know basis.

*It appears that some governors may attempt to prevent certain entities from requiring “immunity passports” (e.g., proof of vaccination) through an executive order (EO), though as of July 31, none of the EOs already issued appear to apply to private businesses and their employees. Also note that if there is a law in place that prevents treating vaccinated and unvaccinated employees differently (like in Montana), you may be able to ask, but not take any action based on the response.

Should we keep a record of who is vaccinated or make copies of vaccination cards? If we do, how long should we keep that information?

If you’re asking about vaccination status, you’ll want to keep some kind of record (so you don’t have to ask multiple times), but how you do this is up to you, unless state or local law has imposed specific recordkeeping requirements. You may want to keep something simple like a spreadsheet with the employee’s name and a simple “yes” or “no” in the vaccination column. If you’d prefer to make a copy of their vaccination card, that should be kept with other employee medical information, separate from their personnel file. Per OSHA, these records should be kept for 30 years.

If we keep a record of who is vaccinated, can we share it with managers who will be required to enforce policies based on that information, such as masking and social distancing?

Yes. We recommend not sharing this information any more widely than necessary. While anonymized information is okay to share (e.g., “80% of our employees are vaccinated”), each employee’s vaccination status should be treated as confidential, even if the fact that they are wearing a mask to work seems to reveal their status publicly. Obviously, managers will need this information if they are expected to enforce vaccination-dependent policies, and employers should train them on how they should be enforcing the policies and how and when to escalate issues to HR or a higher level of management.

Special thanks to the HR Support Center for providing this edition of our HR Question of the Week.

For further COVID-19-related resources, check out our COVID-19 Employer Resources page or contact us for direct assistance.

This article does not, and is not intended to, constitute legal advice. Information and content presented herein is for general informational purposes only and readers are strongly encouraged to contact their attorney to obtain advice with respect to any legal matter. Only your individual attorney can provide assurances that the information contained herein is applicable or appropriate to your particular situation or legal jurisdiction.

What is the Employee Retention Tax Credit (ERTC)?

Last Updatedin HR Compliance

HR Question:

What is the Employee Retention Tax Credit (ERTC) and how can I take advantage of this program?

HR Answer:

As an incentive to employers of all sizes to keep employees on payroll, the Employee Retention Tax Credit (ERTC) was created to help employers navigate the unprecedented impact of COVID-19. The ERTC is a refundable tax credit formed within the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), and further extended/expanded under the Consolidated Appropriations Act (CAA) and American Rescue Plan Act (ARPA).

Originally, to be eligible for the credit as of March 2020, an employer must actively carry on a trade or business during the calendar year 2020 and meet either of the following:

- Full/Partial Suspension Test: If an eligible employer experiences a calendar quarter in which trade or business is fully or partially suspended due to an order of government authority restricting commerce, travel or group meetings (this includes but is not limited to commercial, social and religious purposes) due to the COVID-19 pandemic.

- Gross Receipts Test: If an eligible employer experiences a significant decrease in gross receipts (AKA revenue) resulting in more than a 50% drop when compared to the same quarter in the previous year. (Until gross receipts exceed 80% of gross receipts in the prior quarter).

Originally, the credit was worth 50% of “qualified wages” – including health care benefits – up to $10,000 per eligible employee from March 13, 2020 – December 31, 2020. In other words, the maximum benefit for 2020 resulted in credit of up to $5,000 per employee. Companies can STILL do this today.

CAA Changes

In December 2020, Congress revised the provision resulting in the Consolidated Appropriations Act (CAA), extending the credit for eligible employers that continue to pay wages during COVID-19 closures or recorded reduced revenue through June 30, 2021. The CCA also:

- Increased the amount of the credit to 70% of qualified wages, beginning January 1, 2021, and raised the limit on per-employee qualified wages from $10,000 per year to $10,000 per quarter. In other words, you can obtain a credit as high as $7,000 per quarter per employee.

- Expanded eligibility by reducing the requisite year-over-year gross receipt reduction from 50% to only 20%. And it raised the threshold for determining whether a business is a “large employer” — and therefore subject to a stricter standard when computing the qualified wage base — from 100 to 500 employees.

- Provided that employers who receive PPP loans still qualify for the ERTC for qualified wages not paid with forgiven PPP funds. (This provides an incentive for PPP borrowers to maximize the nonpayroll costs for which they claim loan forgiveness.)

ARPA Changes

The American Rescue Plan Act (ARPA) was created to increase the speed of recovery to the economic and health struggles faced by COVID-19. The new law extended the ERTC through the end of 2021 and expands the pool of employers who can take advantage of the credit by including so-called “recovery startup businesses.” A recovery startup business generally is an employer that:

- Began operating after February 15, 2020, and

- Has average annual gross receipts of less than or equal to $1 million.

While these employers can claim the credit without suspended operations or reduced receipts, it’s limited to $50,000 total per quarter.

The ARPA also targets extra relief at “severely financially distressed employers,” meaning those with less than 10% of gross receipts for 2021 when compared to the same period in 2019. Such employers can count as qualified wages any wages paid to an employee during any calendar quarter — regardless of employer size. Otherwise, the ARPA continues to distinguish between large employers and small employers for purposes of determining qualified wages.

Note that the ARPA extends the statute of limitations for the IRS to evaluate ERC claims. The IRS will have five years, as opposed to the typical three years, from the date the original return for the calendar quarter for which the credit is computed is deemed filed.

Additional IRS Guidance

Prior to the passage of the ARPA, the IRS issued additional guidance on the ERTC that helps determine whether operations were partially suspended because of a COVID-19 related government order.

The IRS has previously stated that “more than a nominal portion” of operations had to be suspended, meaning:

- Gross receipts from the suspended operations are 10% or more of total gross receipts,

- Hours of service performed by employees in the suspended operations are 10% or more of total hours of service, or

- Modifications to operations result in a reduction of 10% or more of the employer’s ability to provide goods or services.

How can my company claim the ERTC?

The ERTC is a payroll tax credit to be reported on Form 941 and may be up to a total of $33,000 per employee for 2020/2021 depending on facts. Any eligible employer can claim ERTC in either/both 2020 and 2021. Special care should be taken when calculating and claiming the credit, especially if the business also received a PPP loan, or other government funding since COVID-19, as IRS rules required an analysis to avoid any “double-dipping.”

Every business is unique and the amount of your ERTC will vary depending on the time period, number of employees, and other factors. To effectively position your business with the benefits of the ERTC, it is encouraged to partner with a tax consultant who knows your industry and the tax laws. To have a discussion about the potential of ERTC during calendar years 2020 and 2021, reach out to Clark Schaefer Hackett consultant Phil Hurak (pshurak@cshco.com) today.

Special thanks to Phil Hurak for writing this edition of our HR Question of the Week!

For additional information regarding the ERTC, please visit the CSH COVID Resource Center containing articles on ERTC, PPP, FFCRA, and other benefits potentially available to your business.

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance page to learn about our auditing services which can help you identify trouble spots in your HR function.

How To Conduct A Workplace Harassment Investigation

Last Updatedin Employee Relations, HR Compliance

In 2020, the EEOC reported over 24,000 claims of harassment and over 11,000 claims of sexual harassment. Harassment in the workplace impacts more than just the individuals in the situation – these conflicts (and how leadership responds) can negatively impact both the culture and the reputation of the company. You must be prepared to quickly respond to harassment claims in order to protect both your employees and the company as a whole. In order to do so, you must have well-known reporting policies and easily implemented workplace harassment investigation procedures.

The first element to consider is to ensure policies and procedures are in place, clearly communicated to employees, and are consistently applied across your organization. When a situation escalates out of an employee’s control, it’s key for them to know how to react, how to report, and who to call.

It can be challenging to uncover the details, key players, and facts in a workplace harassment investigation. It requires an experienced and savvy interviewer to avoid risk and to provide fair and just outcomes. So what steps are important when conducting internal investigations?

Separate the Employees

When HR receives a complaint of harassment, the parties involved should be immediately separated from further contact. This may cause work disruption; however, it’s prudent to prevent any further exposure to what may be harmful interaction. Additionally, it’s important to emphasize that retaliation will not be tolerated under any circumstances.

Conduct Thorough Interviews to Understand the Facts

Conducing the workplace harassment interviews may be the most difficult part of the investigation puzzle. It takes strategic planning and a conscious effort to conduct the investigation without leading the participants in any way. Interviewers should start with basic facts such as details of the incident, when it took place, where it took place, how often the interaction occurred, with whom, how the incident made the employee feel, and the names of witnesses or any evidence such as texts, emails, photos, etc. If the complaining employee is willing to prepare a written statement, the statement can be used to compare interview notes and to ensure nothing was omitted and miscommunicated.

How to approach interviewing the complainant:

When interviewing the complainant, interviewers should explain that every effort will be made to protect the conversations and the individual’s privacy. However, they must also be made aware that in order to properly conduct the investigation, the alleged harasser and other members of leadership may need to be informed. Employees, at times, report an incident, but state that they “don’t want to get anyone in trouble” or “don’t want to get anyone fired.” If you (the employer) are made aware of a potential situation of misconduct, the employee reporting the incident must be informed that you will investigate and take appropriate action in line with organizational policy, integrity, and federal and state laws.

The last part of the interviews should include the timeline for when you plan to conclude the investigation and share outcomes. A best practice is to investigate and return results in no more than two weeks. Rapid closure is the goal.

How to approach interviewing the accused harasser and witnesses:

When interviewing the alleged harasser, interviewers should provide necessary facts about the complaint and ask questions in an effort to provide the employee with an opportunity to share their perspective and/or to provide witnesses and evidence in their favor. Keep in mind, witnesses are not always cooperative. They may wish to stay uninvolved or attempt to protect a friend. The interviewer must gently persuade witnesses, focusing on the importance of their role in the process. Again, the interviewer must ask questions without leading or making any assumptions until all statements and evidence are heard and collected. Impartiality must be maintained for the entire investigation process.

Review the Evidence

Once the investigation is complete, the interviewer should thoughtfully and completely review all notes, materials, and evidence to determine if any company policies have been violated or laws broken. This step can have wide-reaching implications – a flawed investigation can lead to poor morale and discourage employees from reporting future situations. Therefore, the investigator’s role is imperative.

Prepare a Written Report and Concluding Actions

As the investigation wraps up, the investigator should prepare a written report, outlining the facts and violations (if any), used to determine if other action is warranted. If policy or legal violations did take place, management must decide on discipline or corrective action, keeping in mind that this action will set a precedent for future violations.

The final step in the process is to meet with the employee who reported their concerns. The manager or investigator should inform the employee that action was taken to address the problem or that the investigation could not corroborate that company policy was violated. It’s important to note if disciplinary action was taken, the company should not share details about the action with the accusing employee.

If there are concerns with privacy, neutrality, or experienced investigators, outside resources such as HR Consultants or law firms may be engaged to conduct the investigation.

Special thanks to Angela Dunaway, SPHR-SHRM-CP, for contributing to this edition of our Emerging Issues in HR.

Need a neutral third party to conduct internal investigations? Strategic HR can help! Visit our Workplace Investigations page to learn more.

Are Employee Gift Cards Considered Taxable Benefits?

Last Updatedin Benefits & Compensation, HR Compliance

HR Question:

HR Question:

To thank my employees for their extra efforts, I have provided them with a $50 gift card. Accounting is telling me I have to report the value of the gift cards as taxable benefits. Is that true?

HR Answer:

Yes, it’s true! According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn’t apply to all gifts or perks that you may give to employees.

The IRS tells us that we can exclude the value of a “de minimis” benefit from an employee’s wages. For those unfamiliar with a “de minimis” benefit, the IRS defines it as “any property or service you provide to an employee that has so little value (taking into account how frequently you provide similar benefits to your employees) that accounting for it would be unreasonable or administratively impracticable.” Most employers tend to categorize de minimis gifts in the under $50 range, but for some, it can go upward of $100.

In comparison to cash or cash equivalents which are always considered taxable benefits, small gifts have much more flexibility when it comes to tax responsibilities according to the IRS. But how organizations denote “small” is still up for negotiation. When deciding on a gift or fringe benefit for an employee, consider the value and the frequency of the gift or benefit. For example, purchasing a book for an employee for their birthday would be excluded. Purchasing a book every month for an employee would not be excluded due to the frequency of the gift, regardless of the value of the book.

Additional Examples of Tax-Exempt Benefits

Other examples of de minimis benefits include such things as some meals, occasional parties, occasional tickets for events (not season tickets), holiday or birthday gifts (other than cash or cash equivalents). Essentially, occasional gifts that can’t be redeemed for cash value can be considered as these exempted benefits.

There is also an exemption for achievement awards, which come with additional rules of their own. Examples of these gifts include gifts for achievements such as safety milestones or length of service or anniversary milestones. Certain achievement awards can be excluded from the employee’s wages if the awards are tangible personal property and meet certain requirements. Notable exceptions from The Tax Cuts and Jobs Act prohibit certain property as an employee achievement award, including vacations, lodging, stocks, bonds, and securities. Limitations are further detailed in the Act, including $400 maximum for non-plan awards and up to $1600 if you have a documented, non-discriminatory program surrounding the awards.

Additional requirements exist for these achievement awards. For example, length-of-service awards can’t be received during the employee’s first five years of employment or more often than every five years. Also, safety awards can’t be given to more than 10 percent of eligible employees during the same year.

Employee awards are an important part of employee engagement. It is important, however, to make sure you don’t turn that $100 thank you gift card into a much more expensive “gift” by assuring you are properly handling the taxes accompanying such a gift.

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance Services to learn more.

Do We Have to Provide Employees Time Off to Vote?

Last Updatedin Communications, HR Compliance

HR Question:

We received a request from an employee for time off to vote. My state doesn’t require voting leave, but this employee works in a different state, and we have employees located across the country. What do I need to do here?

HR Answer:

If an employee of yours works in a state with a voting leave law, you will need to comply with that law. Most states require that employers provide at least a few hours of employee time off to vote, and many of those states require some or all of that time to be paid. In New York, for example, all registered voters are allowed to take off as much time as is necessary to enable them to vote and are entitled to be paid for up to three of those hours. You’ll also want to check any applicable voting leave laws for notice requirements and for specifications on when during an employee’s shift the time off should be given. You can find all this information on the HR Support Center by entering “voting leave” in the search bar. Workplace Fairness also has an online interactive tool to allow you to look up voting laws by state.

To keep things simple and fair, you might consider implementing a single company policy that meets or exceeds all applicable state requirements. That way there’s no confusion about what your policy is, employees in states without leave requirements won’t feel like they’re being excluded, and everyone in your company will have the opportunity to vote. Some employers even go the extra mile by cancelling all meetings on election day or making that day a paid holiday.

Thank you to our HR Support Center for providing the response to this edition of our HR Question of the Week.

Do you wish your HR Handbook and Job Descriptions would write themselves? Would you like to have 24/7 access to HR forms, checklists, and templates so you don’t have to “recreate the wheel”? Check out our Virtual HR Solutions to see how we can make “going it alone” not so ALONE! In addition to comprehensive online HR resources & tools, you can also have unlimited access to HR professionals via phone/email/chat.

Can I Store My I-9 Forms Electronically?

Last Updatedin HR Compliance

HR Question:

I have heard of other employers storing all of their I-9’s electronically, rather than in paper form. Is that acceptable? Is there anything I need to know before moving to store my I-9 Forms electronically?

HR Answer:

Yes, many employers are moving to the electronic completion and storage of their employees’ I-9 Forms. According to U.S. Citizenship and Immigration Services, you may maintain the forms either electronically or on paper, with a few requirements to keep in mind.

Storing Form I-9s Electronically

If you are storing them offsite, you must be able to produce the documents within 3 days of the request from an auditor. If you decide to maintain your records electronically, you have the option of using an online payroll provider which should allow the employees to complete the form online and store it. Alternatively, you can have employees complete the hard copy paper form and then scan and upload the original signed form. Either option is an acceptable alternative for electronic storage. The paper form can then be destroyed once it has been properly stored electronically.

How to Manage I-9 Verification Documents

Regarding the documents that are provided as “proof” for the I-9, employers are not required to create or attach photocopies of documentation submitted to satisfy the Form I-9 requirements during the employment eligibility verification process, but the practice is permissible. If you choose to make photocopies of the documents, make sure that you do it for ALL employees to avoid any potential claims of discrimination.

Requirements of Electronic Storage Systems

If you are using an electronic system, U.S. Citizenship and Immigration Services (USCIS) require you to make sure the system you are using can meet the following requirements:

- It has controls that ensure the system’s integrity, accuracy, and reliability;

- It has controls that can prevent and detect the unauthorized or accidental creation of, addition to, alteration of, deletion of, or deterioration of an electronically completed or stored Form I-9, including the electronic signature if used;

- You have an inspection and quality assurance program in place that regularly evaluates the system and includes periodic checks of electronically stored Form I-9’s, including the electronic signature if used;

- You have an indexing system that allows users to identify and retrieve records maintained in the system; and

- The system has the ability to reproduce legible and readable paper copies.

In addition, you are required to document the process and procedures used for collecting and maintaining the documents. You can find additional details on the requirements for storing I-9’s electronically on the U.S. Citizenship and Immigration Services website.

Finally, keep in mind that you must have a secure IT system in place. The system should be able to audit who accessed the files and/or edited them, as well as ensure that only authorized individuals have access to the records. You must also have a system in place that ensures the information is securely backed up in the event of a system crash.

How Long You Are Required to Store I-9s

An employer must keep the original Form I-9 for all current employees for as long as they are employed. After an employee terminates employment, the original Form I-9 must be on file for EITHER: three (3) years after the date of hire or one (1) year after employment is terminated – whichever is later. For example:

Scenario A: If an employee is terminated after only 6 weeks on the job, their Form I-9 must be kept for three years after the hire date.

Scenario B: If an employee terminates after 5 years of employment, their Form I-9 must be kept for one year after the date of termination.

Here’s an easy way to calculate the date of Form I-9 retention:

- If an employee worked fewer than three years (Like scenario A above): Add 3 years to the date of hire

- If an employee worked more than three years (Like scenario B above): Add 1 year to the date of termination

- Following the above calculations, use the later of the two dates as the retention date.

Ensuring Storage Safeguards

Storing your I-9’s electronically can be a wonderful solution for these documents – just be sure you have a process in place with the appropriate safeguards and systems. The USCIS warns us that if the records cannot be retrieved during an audit, even if there is proof of a system crash, you will be in violation.

Thanks to Patti Dunham, MBA, MA, SPHR, SHRM-SCP for contributing this edition of our HR Question of the Week!

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance and Recordkeeping page to learn about our auditing services which can help you identify trouble spots in your HR function.

What Should I Consider Before Doing a Reduction in Force?

Last Updatedin Communications, Employee Relations, HR Compliance

HR Question:

I may need to restructure my workforce as a result of the downturn in business activity. What should I consider from a fairness and legal standpoint?

HR Answer:

Determining the need for a Reduction in Force (RIF) is a challenging decision to make, but it is sometimes necessary to keep the business running in a positive way. According to the Society for Human Resource Management (SHRM), the definition of a RIF “occurs when changing priorities, budgetary constraints, or other business conditions require a company to abolish positions.”

Before moving forward with a RIF, we recommend that you thoroughly consider all of your options. Some states offer assistance to employers that may help them avert layoffs or receive early intervention to help the workforce impacted by a RIF. For example, Ohio Job and Family Services’ Office of Workforce Development offers a Rapid Response (RR) program that is funded by the U.S. Department of Labor. Services may include customized workshops, training, up-skilling, retooling, certifications or skill matching.

If you determine that your organization needs to move forward with a reduction in force, you should use a carefully planned approach. You will need to be aware of and adhere to state and federal regulations to ensure compliance throughout your process. This will help to protect your organization against employment litigation. It is also important to train your management staff on what they can and cannot do in the RIF process. This is a time to go back to the basics when it comes to managing your human resources and protecting your business.

8 Recommended Steps to Follow When Considering a Reduction in Force

1. Select the Employees for the Layoff

It’s important to determine an objective criteria process for your selection process. Consider factors such as criticality of the position to the business, seniority, performance review scores and any corrective action documents that may have been issued. This is the time that accurate and timely employee documentation throughout the year is important as it will play a big part in your selection process.

You will need to remind managers of the importance of using objective criteria in the selection process and not to make decisions based on who they like or dislike. You may also consider having a “no backfill for one year” rule to ensure the RIF is truly necessary and not a way for managers to “clean house.”

Once you have an initial list of employees to be laid off, you should apply steps 2 – 5 below to ensure that you are in compliance with state and federal regulations.

2. Avoid Adverse / Disparate Impact

According to SHRM, adverse or disparate impact refers to “employment practices that appear neutral but have a discriminatory effect on a protected group. Adverse impact may occur in hiring, promotion, training and development, transfer, layoff, and even performance appraisals.” For help in understanding and navigating this, check out SHRM’s toolkit to avoid adverse impact in employment practices.

3. Review Federal and State WARN Regulations

If an organization is contemplating a RIF or a layoff, there are several factors to take into consideration such as reviewing state and federal statutes, including the Worker Adjustment and Retraining Notification Act (WARN). WARN offers protection to workers and even communities by requiring employers to provide a 60-day notice in advance of a plant closing or what they deem as a mass layoff. This Act is only applicable to employers with 100 or more employees.

4. Review ADEA and OWBPA Regulations

You will need to comply with two federal regulations that offer protections based on age: ADEA and OWBPA.

The Age Discrimination in Employment Act (ADEA), protects employees 40 years of age and older from discrimination on the basis of age in hiring, promotion, discharge, compensation, or terms, conditions or privileges of employment.

The Older Workers Benefit Protection Act (OWBPA) is an Act that amends the ADEA to clarify the protections given to older individuals in regard to employee benefit plans, and for other purposes.

5. Determine Severance Packages, Benefits Coverage, and Additional Services (if any)

As you develop severance packages, benefits coverage, and any other services that you will offer, you should review the Employee Retirement Income Security Act (ERISA) to ensure compliance. ERISA is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

6. Train Supervisors and Managers

These individuals are your first-line of defense (and many times your biggest legal threat) when it comes to employees’ perception of company policies, procedures, and decisions. Although human resources would always like to be the ones to address employee concerns, your front-line managers and supervisors are doing it on a daily basis whether they want to be or not. They should be properly trained on how to handle employee concerns.

Some suggestions for supervisor/manager training include:

- Basic Discrimination Laws: Be sure supervisors and managers are aware of basic discrimination laws. Assist them with increased communication and employee relation skills so they are able to respectfully support company decisions and communicate with employees regarding their concerns or issues.

- Staying Compliant and Consistent: Ensure managers and supervisors are clearly aware of what they can and cannot do from a legal perspective. Those involved in the employment process should know and document the process used when restructuring or selecting employees for layoff, and then use it – consistently. A clear legally defendable (non-discriminatory) reason when selecting those who will be let go is the most important aspect of restructuring. In addition, managers and supervisors should be guided by human resources to ensure an appropriate message is being delivered when HR isn’t delivering it.

- How to Maintain Good Documentation:We all know that documentation is essential for a good legal defense, but also remember it can hurt as well. Train your staff on what good documentation looks like and what to avoid. Remind them that everything is subject to review in a lawsuit – employee warnings, performance evaluations, and even those simple notes we write down on a sticky note and throw in their file. Be aware of what you are putting down into writing and make sure it is objective and defendable.

7. Prepare for Reduction in Force Meetings

As you prepare for your layoff meetings, have a clear plan of what is going to be communicated, who is responsible for communicating the message, and how the message will be delivered both to those who are being directly impacted and those who will remain. It can be helpful to think through your anticipated frequently asked questions and prepare answers prior to your meetings.

8. Inform Your Workforce of the Layoffs

As you deliver the news of your reduction in force, remember that the golden rule still stands in employment – treat your employees the way you would like to be treated. Think about how you would prefer to be treated during these tough times when decisions are so difficult. Treat your employees with dignity and respect at all times. Provide notice of the layoff if it is reasonable, and provide some type of outplacement if you are able.

Be sure to listen to your employees as well. Employees are more likely to file a claim against employers when they feel like they are ignored or that their concerns are not addressed. Although your message may not always be what they want to hear – allow them to be heard and feel a part of the process.

Remember also, the RIF not only effects the person being released from his/her job, but also the remaining employees. There can be an emotional toll on those who remain, in addition to the impact it may have on their job duties as well. Be prepared to provide the resources and tools necessary to help your staff to stay engaged and do well through this difficult time of transition.

How to Handle Changes to Job Responsibilities

Moving forward, your next consideration is to have a plan about who will absorb each exited person’s job tasks. You should determine if this situation requires a long term solution or if you foresee returning to the prior structure again when the budget allows. Job descriptions for those positions affected by the lay-off will need to be reviewed to reflect changes to the responsibilities and functions of the position. Sometimes you may find the change has actually improved the position making it more efficient.

You may also want to consider a salary review for the positions affected. Since some individuals are now performing the functions of multiple positions, is a pay increase warranted and feasible?

Remember, the job description is based upon the position itself, not the individual performing the job. Make sure to get input from all relevant parties – supervisor and employee – when determining the final role of an impacted position.

In addition, we recommend that you consider cross-training employees on job tasks to be ready for these unforeseen times and to have coverage in the absence of employees when they are out of the office for personal reasons.

To ensure your compliance with all federal and state laws and regulations in the process of a reduction in force, we encourage you to consult with your attorney to review your plans before implementation. Be prepared with a plan and look at the strengths and weaknesses of your team so you are not caught off guard!

If your business is considering a reduction in force, the team at Strategic HR is available to help coach you through the process and decisions that will need to be made. We are here to help you through the tough times – just contact us.

Compensating Employees for Travel Time

Last Updatedin HR Compliance

Question:

We have employees who occasionally have to travel from one of our offices to another during their work day. Are we required to pay them for their travel time?

Answer:

This is a very common situation, and the quick answer is it depends. Exempt employees generally are not entitled to additional compensation for travel time, so when evaluating whether or not to compensate for travel time you should focus only on your non-exempt staff. Work-related travel time NOT connected to the employee’s regular commute to and from work should generally be compensated and count toward an employee’s hours worked for the purposes of calculating overtime.

You should also have your travel time pay practices and policies reviewed by your legal counsel for the states and localities in which your employees are working to ensure compliance with applicable laws, and to ensure that your policies and practices are appropriate to your particular situation.

If an employee is commuting from home to their usual work site, it is not counted as compensable work hours; however, non-exempt employees who travel as part of their principal working duties should be compensated. Examples might include an office administrator traveling between multiple offices for meetings or a repairman going from one assignment to the next.

Another example of compensable travel time is if the employee is traveling from home to a non-typical work location and back home in the same day. The amount of time that the employee spends traveling to and from the non-typical work location that exceeds the employee’s normal commute is considered compensable travel time.

Generally, employees should be compensated for all time spent traveling during regular business hours.

Please bear in mind that laws exist in numerous states that provide expanded definitions of travel time or impose additional requirements for travel time pay. The Fair Labor Standards Act (FLSA) addresses this issue specifically in Section 29 CFR § 785.38 (Portal-to-Portal Act).

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance and Recordkeeping page to learn about our auditing services which can help you identify trouble spots in your HR function.

How to Manage Creditable Coverage Reporting and Notices

Last Updatedin HR Compliance

HR Question:

I reported “creditability” of my prescription plans in March of this year and now I am getting notices that it is due in October. Are these the same notices? Is this the same creditable coverage document and what do I need to do?

HR Answer:

Creditable coverage documents and notices can be confusing because they include two different “parts.” Do not confuse the reporting of Creditability to the Centers for Medicare and Medicaid Services (CMS) with the notices you must provide to your employees.

Group health plans offering prescription drug plans to members over the age of 65 (whether primary or secondary coverage) are required to report the creditability of the plan and provide those eligible for coverage a creditability notice. Employers must provide not only those employees and dependents insured under the plan, but also those that may be eligible to be insured under the plan, a Creditable Coverage notice. This document informs individuals whether or not the drug coverage your plan provides is creditable or actuarially equivalent to what is available under the standard Medicare Part D plan.

These notices must be sent out AT LEAST once a year BEFORE October 15 and prior to an individual’s initial Medicare enrollment period. The easiest way to do this is to send it to ALL PARTICIPANTS annually, and easier yet is to add it to the open enrollment materials which can include this along with all of the other alphabet soup items necessary for distribution (SPD, CHIPRA, HIPAA, WHCHRA, etc.) A sample of the notices that must be distributed can be found in this DOL compliance assistance guide.

Specifically, the Medicare Part D Creditable Coverage notices (creditable and non-creditable) are provided by the Centers for Medicare and Medicaid Services.

The notices to employees (above) should not be confused with CMS notification. In addition to the notices provided to employees, employers are also required to report the creditability of their plan online to CMS each year. For plans that are on a calendar year (think January renewal), creditability must be reported no later than March 1 using the Disclosure to CMS Form. The online disclosure should be completed annually no later than 60 days from the beginning of a plan year, within 30 days after termination of a prescription drug plan, or within 30 days after any change in creditable coverage status. Because of these different due dates, it may be easier for employers to send out BOTH notices in March rather than October.

With all of these requirements, there is good news! Your broker or group healthcare provider can tell you whether or not your plan is creditable AND The Centers for Medicare and Medicaid Services provides the model notices and a direct link to the online form for reporting. Creating and distributing these notices should be fairly easy and a quick item to knock off your to do list. Just get the notices on your calendar each year and don’t forget to include both pieces.

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance & Recordkeeping page to learn about our auditing services which can help you identify trouble spots in your HR function.

Post-Accident Drug Test: Workers Compensation?

Last Updatedin HR Compliance

Question:

Say what? The employee who failed his post-accident drug test gets workers compensation?

Answer:

Employers might assume that an injured worker’s positive post-accident drug or alcohol test will automatically defeat a related workers’ compensation claim. However, in Ohio at least, the reality is a bit more complicated. Under Ohio law, a positive, post-accident drug test raises only a “rebuttable presumption” that the injured worker’s use of drugs or alcohol proximately caused the industrial injury. Since this legal presumption is “rebuttable,” the burden then shifts back to the employee to prove that the impairment did not cause the accident. This burden-shifting “rebuttable presumption” can be a potent defense to some claims. However, the presumption is triggered only if the following elements are first satisfied:

- The employer must have previously posted written notice that a positive test may disqualify the employee from benefits. To satisfy this requirement, employers often include this notice in their substance abuse section of the employment handbook.

- The detected levels of alcohol or other controlled substances must have been above the applicable threshold. These levels are mandated by federal law. Alternatively, if the injured worker refuses to submit to a test, the presumption will be triggered.

- A post accident test will qualify for the presumption only where: (1) the employer had reasonable cause to suspect that the employee was under the influence of drugs or alcohol at the time of the accident; (2) the testing was done at the request of a police officer; or 3) the testing was done at the request of a licensed physician, who is not otherwise employed by the employer.

Ohio law defines “reasonable cause” as evidence that an employee is or was using alcohol, a controlled substance, or marijuana, drawn from specific, objective facts and reasonable inferences drawn from those facts in light of experience and training. Examples of reasonable cause might include: direct observation of use; pattern of abnormal conduct; criminal investigation of employee for drug use; report of use by credible source; or repeated or flagrant violations of the safety or work rules of employer.

These requirements seem to create a conflict between the rebuttable presumption rule and an employer’s right to implement a zero tolerance drug policy at their workplace. In fact, Ohio law specifically addresses this tension. The statute provides that “nothing in this section shall be construed to affect the rights of an employer to test employees for alcohol or controlled substance abuse.” See O.R.C. §4123.54(D).