Are Employee Gift Cards Considered Taxable Benefits?

Last Updated on October 12, 2022 / Benefits & Compensation, HR Compliance

HR Question:

HR Question:

To thank my employees for their extra efforts, I have provided them with a $50 gift card. Accounting is telling me I have to report the value of the gift cards as taxable benefits. Is that true?

HR Answer:

Yes, it’s true! According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn’t apply to all gifts or perks that you may give to employees.

The IRS tells us that we can exclude the value of a “de minimis” benefit from an employee’s wages. For those unfamiliar with a “de minimis” benefit, the IRS defines it as “any property or service you provide to an employee that has so little value (taking into account how frequently you provide similar benefits to your employees) that accounting for it would be unreasonable or administratively impracticable.” Most employers tend to categorize de minimis gifts in the under $50 range, but for some, it can go upward of $100.

In comparison to cash or cash equivalents which are always considered taxable benefits, small gifts have much more flexibility when it comes to tax responsibilities according to the IRS. But how organizations denote “small” is still up for negotiation. When deciding on a gift or fringe benefit for an employee, consider the value and the frequency of the gift or benefit. For example, purchasing a book for an employee for their birthday would be excluded. Purchasing a book every month for an employee would not be excluded due to the frequency of the gift, regardless of the value of the book.

Additional Examples of Tax-Exempt Benefits

Other examples of de minimis benefits include such things as some meals, occasional parties, occasional tickets for events (not season tickets), holiday or birthday gifts (other than cash or cash equivalents). Essentially, occasional gifts that can’t be redeemed for cash value can be considered as these exempted benefits.

There is also an exemption for achievement awards, which come with additional rules of their own. Examples of these gifts include gifts for achievements such as safety milestones or length of service or anniversary milestones. Certain achievement awards can be excluded from the employee’s wages if the awards are tangible personal property and meet certain requirements. Notable exceptions from The Tax Cuts and Jobs Act prohibit certain property as an employee achievement award, including vacations, lodging, stocks, bonds, and securities. Limitations are further detailed in the Act, including $400 maximum for non-plan awards and up to $1600 if you have a documented, non-discriminatory program surrounding the awards.

Additional requirements exist for these achievement awards. For example, length-of-service awards can’t be received during the employee’s first five years of employment or more often than every five years. Also, safety awards can’t be given to more than 10 percent of eligible employees during the same year.

Employee awards are an important part of employee engagement. It is important, however, to make sure you don’t turn that $100 thank you gift card into a much more expensive “gift” by assuring you are properly handling the taxes accompanying such a gift.

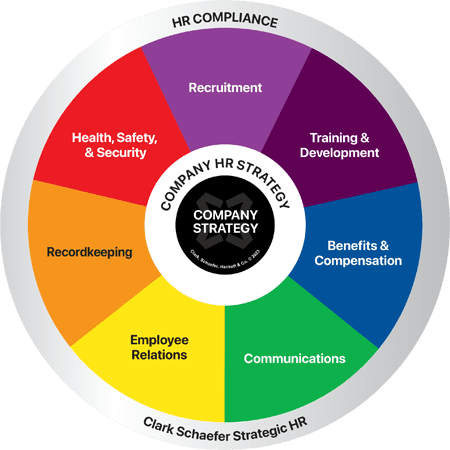

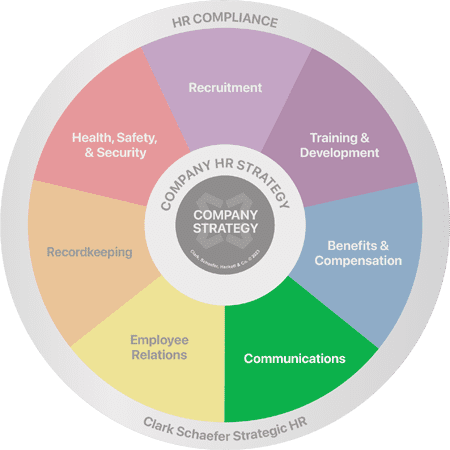

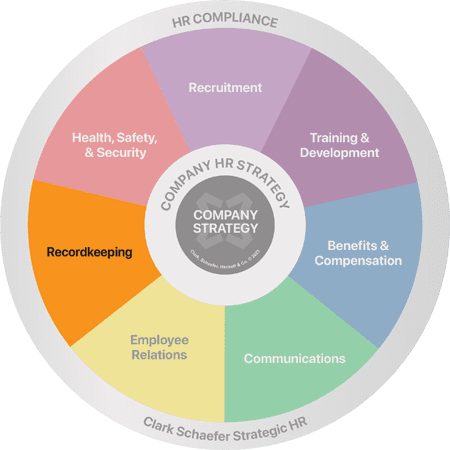

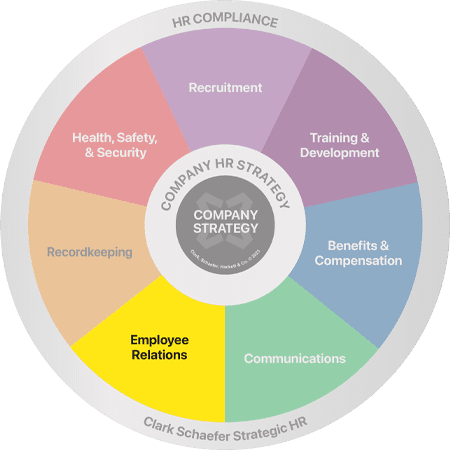

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions and offering resources to help you identify and mitigate compliance issues. Visit our HR Compliance Services to learn more.