How Long Should We Keep Resumes and Applications?

HR Question:

We’ve received a lot of resumes recently – some for positions we’ve posted and some unsolicited. Do we have to keep all these resumes, and if so, how long do we need to retain resumes and applications?

HR Answer:

Best practice is to retain all job applications and resumes – solicited or unsolicited – for a minimum of two years from the date of the hiring decision. Although most records only need to be retained for one year, there are a few reasons why retaining them for two years can provide greater security. Employers are responsible for following all federal laws under which they are covered, as well as any contractual requirements (e.g. union contracts) for all record retention.

Major federal laws that address how long to retain applications and resumes include:

-

Title VII of the Civil Rights Act of 1964

Requires employers to keep various employment records, including job applications, for one year from the date the application was received.

-

Age Discrimination in Employment Act

Requires employers to retain employment applications for one year. There is language, however, that indicates if you are aware the applicant is over age 40, you should retain it for as long as two years.

-

Americans with Disabilities Act

Requires employers to retain job applications and documents for one year. Some variation exists based upon whether or not the applications are solicited or unsolicited, but the maximum retention is two years.

-

Executive Order 11246

Record retention as related to government contractors includes the retention of applications for two years. As of January 2025, however, that Executive Order is no longer technically “in effect”. Until we fully know the impact of applicant record retention, it is recommended that you stay with the two year retention period. Federal contracts formerly subject to OFCCP’s requirements on recordkeeping are still subject to overlapping requirements from Title VII and EEOC.

Other situations impact how long to retain applications and resumes:

Although this seems fairly straightforward, heed the word of caution because many exceptions exist. Consider these other situations impacting the retention of resumes and applications.

-

Legal Dispute

For discrimination charges or lawsuits filed against your organization, all relevant records must be retained until the matter is resolved. When a charge is not resolved after an investigation, additional periods for recordkeeping apply. It can get tricky, so err on the safe side and consult with HR and/or counsel.

-

State Laws

While most states have the same requirements as federal regulations, some states have unique recordkeeping requirements for applicants. Review your state requirements.

-

Handling of Unsolicited Resumes and Applications

You are not obligated to store unsolicited resumes sent to your organization. When you review an unsolicited resume or application, however, those items are often then seen as having been considered for employment. In that case, you’re obliged to retain it with other solicited applications in response to an ad or post.

- Have you ever kept an unsolicited resume thinking, “maybe later”? For resumes you have reviewed and kept for further consideration, your best approach is to keep them for the same duration as you retain your solicited resumes.

- If your Website or Applicant Tracking System (ATS) automatically accepts unsolicited resumes, it may be easy to keep those, unless the retention of these documents becomes costly due to storage requirements.

-

Revisiting Past Resumes or Applications

If you have a resume from a previous search and decide to consider it for a new position down the road, maintain that resume for the time required based on the last viewing of the document for the more recent position.

When considering record retention, identify all documents related to the application you need to keep. Not only do you need to keep the resume or application, you must also retain supporting applicant documentation. This would include items such as:

- Screening tools

- Interview notes

- Assessments

- Background and reference checks

- All related documents leading to a hiring or non-hiring decision, as well as the offer or rejection letter

Maintaining applicant records is important for compliance with anti-discrimination laws, potential legal challenges, and ensuring a fair and equitable hiring process. Regularly review and update your record retention policies. This review will ensure compliance with evolving laws and best practices. And finally, remember to carefully consider how you dispose of applications. When you’re ready to “toss” those applications with confidential data, shred it or safely delete the electronic data.

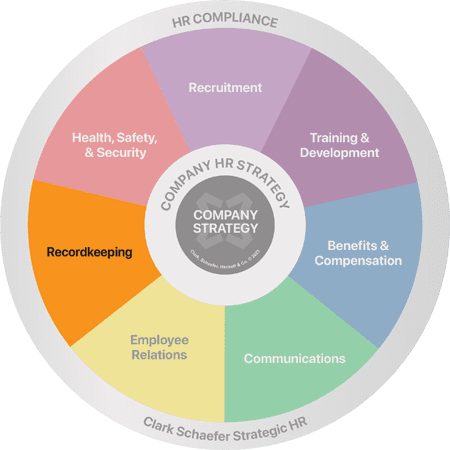

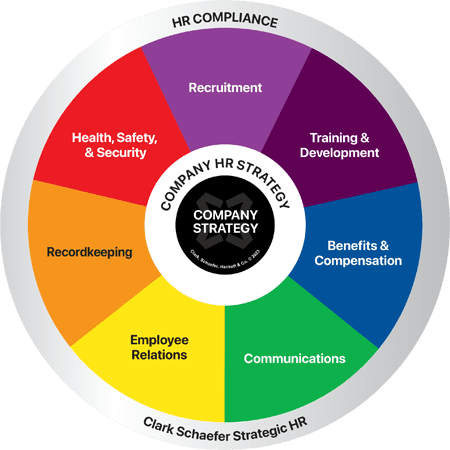

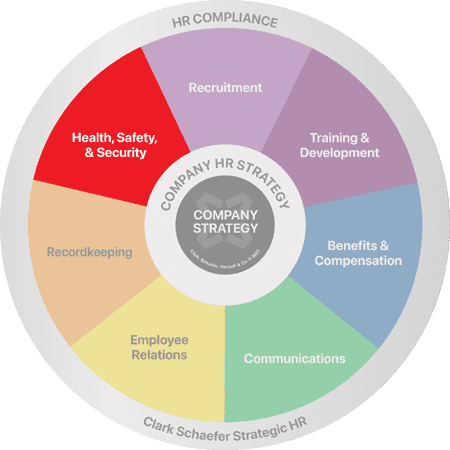

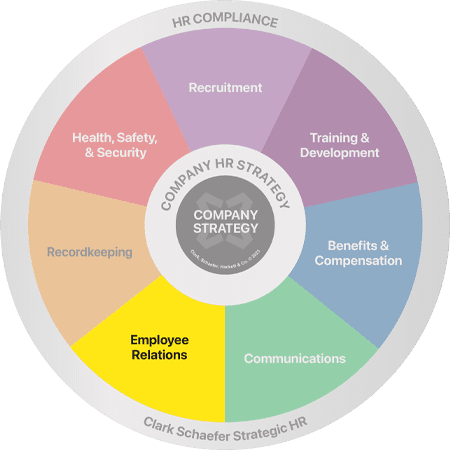

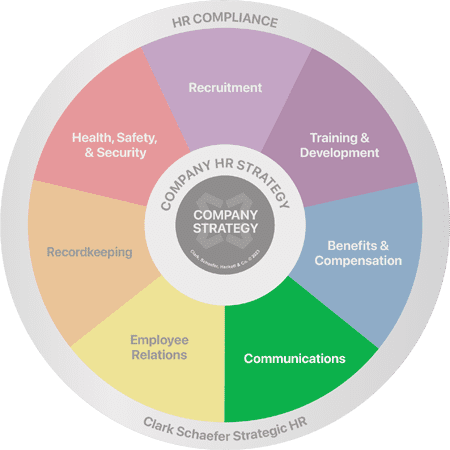

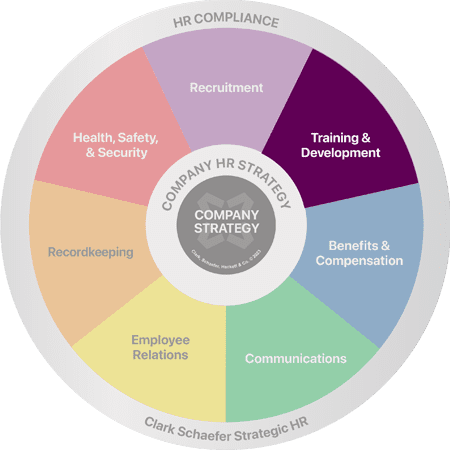

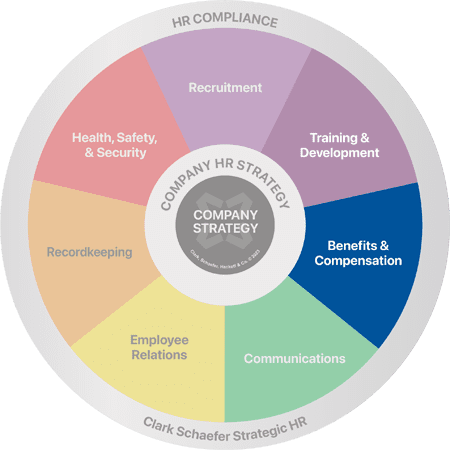

Recordkeeping can be a daunting task, especially when you are trying to clean out old records and maintain the pertinent ones to remain compliant. Clark Schaefer Strategic HR understands your frustration and has many tried-and-trusted tips on recordkeeping. Visit our HR Compliance & Recordkeeping Services to learn more about ways we can help you to get your employment records in order.

HR Question:

HR Question: