How Can I Support Employee Well-Being Beyond the EAP?

HR Question:

Our HR team is exploring ways we can support employee well-being in addition to offering an EAP. What should we consider in our approach?

HR Answer:

While many organizations have implemented an Employee Assistance Program (EAP) as an important way to support their employees’ mental health, that is only one component of well-being. There are many ways HR can play a direct role in supporting employees’ overall well-being. In this article, we’ll discuss what well-being is, how it impacts individuals and organizations, and offer specific examples of how you can support employee well-being in your organization.

What is well-being?

Well-being is the holistic state of an individual’s physical, mental, social, spiritual, and financial health as well as a sense of career and community. It can include things such as work-life balance, stress, job satisfaction, and financial confidence, just to name a few. Essentially, it’s what makes humans human.

A common misconception is that wellness and well-being are the same thing, however, they are not. Wellness is one component of a person’s overall health, while well-being encompasses all aspects of a person’s health factoring in mind, body, and spirit.

Can employee well-being impact your bottom line? (Spoiler: Yes!)

In addition to promoting the fundamental principle of valuing your employees, there is evidence demonstrating the advantages of enhancing employee well-being. Employers that focus on their employees’ overall well-being see the results not only directly with their employees, but in business outcomes.

According to research from the McKinsey Health Institute and the World Economic Forum, employers that take steps to nurture employee health and well-being experience decreased turnover and absenteeism, heightened employee engagement, increased profitability, elevated productivity, enhanced safety, and lower healthcare costs.

The results are clear – physical, mental, social, and spiritual well-being are inextricably linked to work, productivity, and performance. Investing in employee health and well-being can be seen as both an ethical obligation and a smart strategic business decision.

What can employers do to support employee well-being?

There are a number of resources that employers can lean into to enhance their employees’ overall health. Some ideas on how you can support your team include:

Consider all areas of well-being.

Many employers encourage physical fitness and offer ways to stay physically fit (i.e., company-wide step challenges, company-sponsored 5K teams, etc.). However, it’s important to think beyond that to promote other areas such as mental, social, and financial health. If you’re not sure what’s important to your team, consider conducting an employee pulse survey to help you make informed decisions on what your employees will value most.

Be aware of gaps and those disproportionately impacted.

Well-being is not a one-size-fits-all scenario. The Great Place to Work Well Being Survey Report provides key insights looking at differences in well-being across different demographic groups, including gender, age, ethnicity, and job level. You may find that it could be beneficial to offer extra support for some subsets of your staff.

Look at what others are doing!

Why recreate the wheel when you don’t need to? Check out these examples of well-being programs being offered by the Fortune 100 Best Companies to Work For. Even if you don’t choose to offer the same programs, learning what is working well for other companies can sometimes inspire ideas that will work for your organization.

Expand your benefits offerings.

How do your current benefits support well-being? If this is an opportunity for improvement, consider adding options such as paid time off, flexible work arrangements, employee assistance programs, financial advisory services, and well-being initiatives. Of course, offering them is not enough, it is also critical to have a solid HR communication plan in place to ensure employees are aware of these benefits and to eliminate any hurdles to using them.

Create a culture of care.

Offer programs and opportunities that build camaraderie, encourage acts of kindness and connection, encourage communication, and workplace civility. Many organizations have found company-supported community involvement activities to be a great way for their teams to not only feel good about doing good in their communities, but it also allows for them to spend meaningful time together. Consider offering volunteer time off (VTO) to alleviate any financial barriers to participation.

Consider low-cost, high-impact options.

Remember there are actions you can take that don’t need to break the bank. Look for low and no-cost ways to support employee well-being. For example, you can support healthy work-life balance with a simple, yet significant statement in your email signature, such as “Please know we work flexibly in our organization. If you receive this message outside of your normal work hours, no response is expected until your next planned work day.” This sends a powerful message about how your organization values work-life balance.

Prioritizing Employee Health

The costs of employee well-being are too high not to pay attention. Regardless of the action your organization chooses to take, it’s important to remember that work and personal life are not mutually exclusive. Work life influences home life and vice versa, as much as we wish it would not. Ignoring or not supporting one or the other has serious potential consequences. If you’re not sure about the best ways to leverage your financial and time resources, ask your employees. You may learn that they are willing to take cuts in pay to continue to work from home or have other well-being benefits that positively impact them, their family, and/or their lives outside of work. We have found that every effort you make to help better the lives of your employees ultimately comes back to better your organization as well.

Thank you to Patti Dunham, MBA, MA, SPHR, SHRM-SCP, Director of Business Strategy & Quality and Julie Johnson, PHR, SHRM-CP, Senior HR Business Strategist for contributing to this HR Question of the Week.

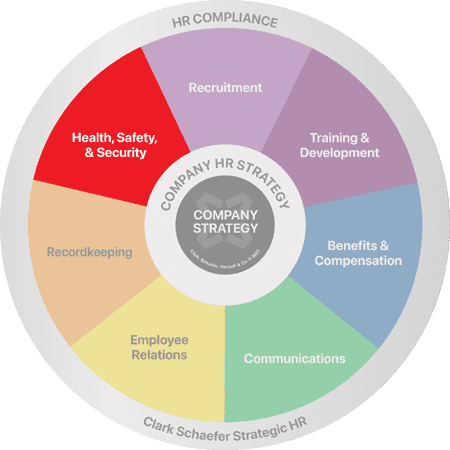

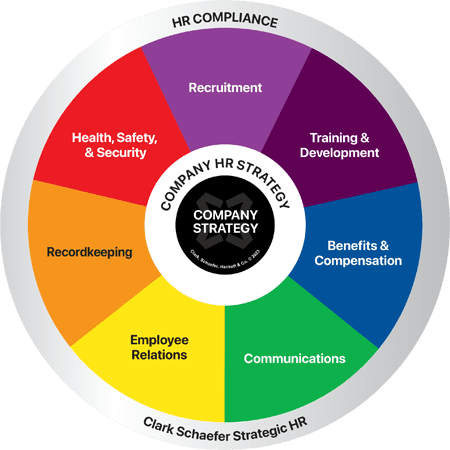

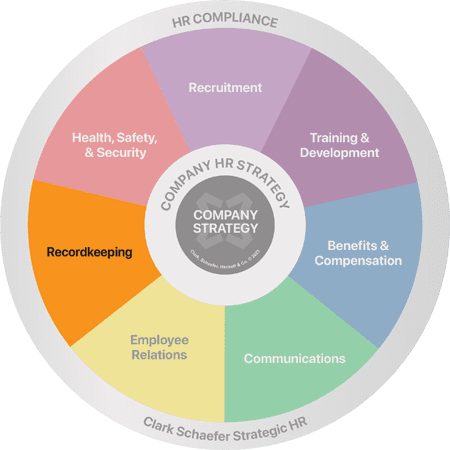

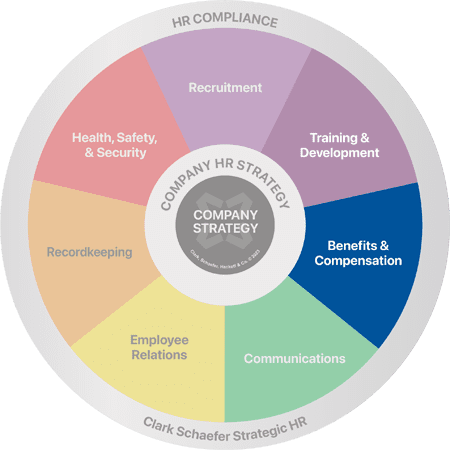

Investing in employee well-being is not just an ethical obligation, but a strategic business decision that can lead to increased productivity, engagement, and overall success. Take advantage of our comprehensive Health, Safety, and Security services to support your team’s holistic well-being and create a thriving workplace. Contact us to learn more about how we can help you prioritize employee health and well-being.

HR Question:

HR Question: