Posts

Designing a Modern Dress Code for Today’s Workplace

Last Updatedin Communications Question of the Week

What is Equal Pay Day?

Last Updatedin Benefits & Compensation Question of the Week

How To Organize Employee Records And Remain Compliant

Last Updatedin Recordkeeping Question of the Week

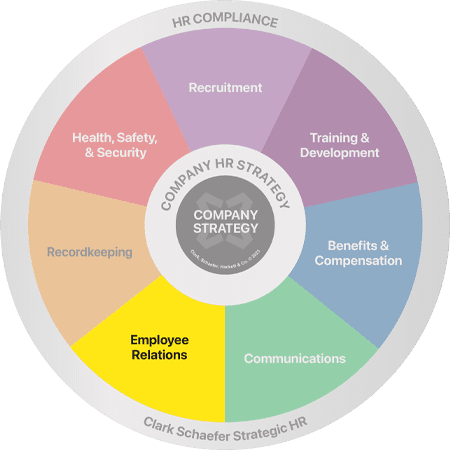

How To Set Up The HR Function In Your Company

Last Updatedin HR Strategy Question of the Week

Could Sabbaticals Be Your Next Retention Tool?

Last Updatedin Benefits & Compensation, Employee Relations Question of the Week

How Can You Teach a Manager to be a Good Listener?

Last Updatedin Communications Question of the Week

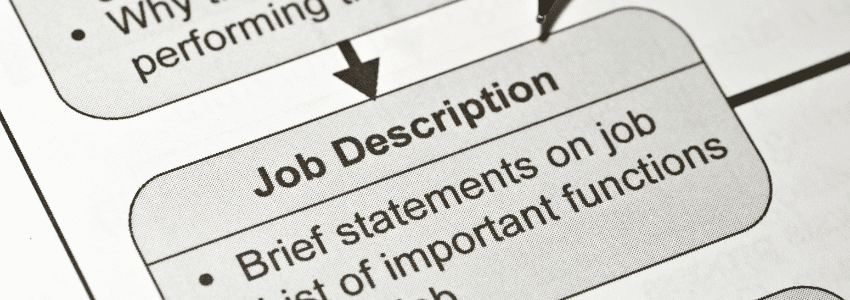

What is the Value of Job Descriptions?

Last Updatedin Communications, HR Compliance Question of the Week

What are the Essentials of a Good Employee Relations Plan?

Last Updatedin Employee Relations Question of the Week

How to Develop a Strategic Plan for Your Business

Last Updatedin HR Strategy Question of the Week

Why Is It Important To Get An Employee’s Signature?

Last Updatedin HR Strategy, Recordkeeping Question of the Week

Are Employee Gift Cards Considered Taxable Benefits?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

How To Determine If A Home Office Injury Is Covered By Workers’ Compensation

Last Updatedin Health, Safety & Security Question of the Week

How Can I Stop Candidates From Ghosting After Accepting an Offer?

Last Updatedin Recruitment Question of the Week

Tips For How To Have Difficult Conversations With Employees

Last Updatedin Communications Question of the Week

How Can I Prevent Unethical Behavior On My Team?

Last Updatedin HR Compliance Question of the Week

Mental Health Concerns in the Workplace

Last Updatedin Benefits & Compensation, Health, Safety & Security, HR Strategy Question of the Week

Do Our Remote, Out-of-State Employees Qualify for FMLA?

Last Updatedin HR Compliance Question of the Week

Should We Abolish Performance Improvement Plans?

Last Updatedin Employee Relations Question of the Week

What’s the Most Effective Way to Use Panel Interviews?

Last Updatedin Recruitment Question of the Week

Why Employee Retention is More Important Now Than Ever

Last Updatedin Employee Relations Question of the Week

Strategies for Managing Change in Your Organization

Last Updatedin HR Strategy Question of the Week

Bonus Grants: A Creative Way to Retain and Reward Key Employees

Last Updatedin Benefits & Compensation Question of the Week

Compensating Employees for Travel Time

Last Updatedin HR Compliance Question of the Week

How to Handle Unemployment Fraud?

Last Updatedin Employee Relations Question of the Week

What is a Certificate of Qualification for Employment?

Last Updatedin HR Compliance, Recruitment Question of the Week

Contact Us

Clark Schaefer Strategic HR (CSSHR)

10856 Reed Hartman Hwy

Suite 225

Cincinnati, OH 45242

Clark Schaefer Strategic HR (CSSHR) is recognized by SHRM to offer Professional Development Credits (PDCs) for SHRM-CP® or SHRM-SCP® recertification activities.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice about their particular situation and relevant jurisdiction. This website contains links to other third-party websites. These links are only for the convenience of the reader, user or browser; Clark Schaefer Strategic HR (CSSHR) does not recommend or endorse the contents of the third-party sites.