Posts

How To Handle Drug and Alcohol Abuse in the Workplace

Last Updatedin Health, Safety & Security Question of the Week

Can I Fire Someone During Their Introductory Period?

Last Updatedin Employee Relations Question of the Week

Why Is Harassment Training Important?

Last Updatedin Training & Development Question of the Week

Do I Need a Heat Safety Plan? How Do I Build One?

Last Updatedin Health, Safety & Security Question of the Week

Federal Employment Poster Requirements for On-Site and Remote Workers

Last Updatedin HR Compliance, Recordkeeping Question of the Week

How Do We Create An Emergency Preparedness Plan?

Last Updatedin Health, Safety & Security Question of the Week

When Do I Have to Deliver an Employee’s Final Paycheck?

Last Updatedin Benefits & Compensation Question of the Week

Designing a Modern Dress Code for Today’s Workplace

Last Updatedin Communications Question of the Week

How Can HR Professionals Reduce Workplace Violence?

Last Updatedin Health, Safety & Security Question of the Week

What is Equal Pay Day?

Last Updatedin Benefits & Compensation Question of the Week

How To Organize Employee Records And Remain Compliant

Last Updatedin Recordkeeping Question of the Week

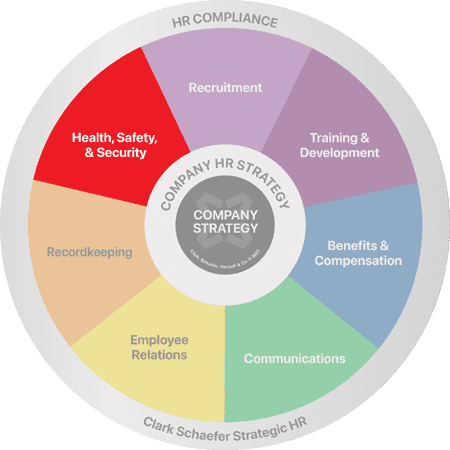

How To Set Up The HR Function In Your Company

Last Updatedin HR Strategy Question of the Week

Could Sabbaticals Be Your Next Retention Tool?

Last Updatedin Benefits & Compensation, Employee Relations Question of the Week

What is the Value of Job Descriptions?

Last Updatedin Communications, HR Compliance Question of the Week

What are the Essentials of a Good Employee Relations Plan?

Last Updatedin Employee Relations Question of the Week

Why Is It Important To Get An Employee’s Signature?

Last Updatedin HR Strategy, Recordkeeping Question of the Week

How To Determine If A Home Office Injury Is Covered By Workers’ Compensation

Last Updatedin Health, Safety & Security Question of the Week

How Can I Prevent Unethical Behavior On My Team?

Last Updatedin HR Compliance Question of the Week

Bonus Grants: A Creative Way to Retain and Reward Key Employees

Last Updatedin Benefits & Compensation Question of the Week

Does My Company Need an AED?

Last Updatedin Health, Safety & Security Question of the Week

Compensating Employees for Travel Time

Last Updatedin HR Compliance Question of the Week

How to Handle Unemployment Fraud?

Last Updatedin Employee Relations Question of the Week

How to Handle Political Talk During the Work Day

Last Updatedin Employee Relations Question of the Week

What is a Certificate of Qualification for Employment?

Last Updatedin HR Compliance, Recruitment Question of the Week

Contact Us

Clark Schaefer Strategic HR (CSSHR)

10856 Reed Hartman Hwy

Suite 225

Cincinnati, OH 45242

Clark Schaefer Strategic HR (CSSHR) is recognized by SHRM to offer Professional Development Credits (PDCs) for SHRM-CP® or SHRM-SCP® recertification activities.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice about their particular situation and relevant jurisdiction. This website contains links to other third-party websites. These links are only for the convenience of the reader, user or browser; Clark Schaefer Strategic HR (CSSHR) does not recommend or endorse the contents of the third-party sites.