Posts

Do I Have to Provide Employees Time Off to Vote?

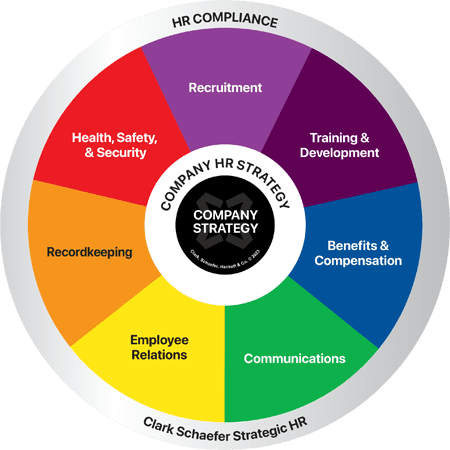

Last Updatedin Benefits & Compensation, Communications, HR Compliance Question of the Week

How To Follow ACA Reporting Requirements & Avoid Penalties

Last Updatedin HR Compliance Question of the Week

How Long Should We Keep Resumes and Applications?

Last Updatedin Recordkeeping Question of the Week

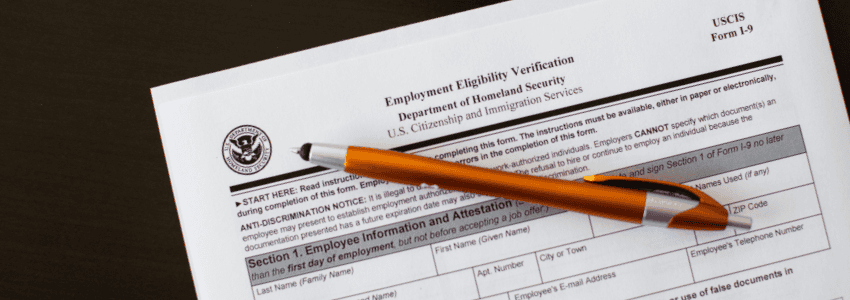

How Do I Handle Missing or Incorrect I-9 Forms?

Last Updatedin HR Compliance, Recordkeeping Question of the Week

What Employers Need To Know About Michigan’s Earned Sick Time Act (ESTA)

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

How to Manage Creditable Coverage Reporting and Notices

Last Updatedin HR Compliance Question of the Week

Do I Need a New I-9 Form for a Name Change?

Last Updatedin HR Compliance, Recordkeeping Question of the Week

What are the Best HR Practices for the End of the Year?

Last Updatedin HR Compliance, HR Strategy, Recordkeeping Question of the Week

What to do if the IRS notifies you of Affordable Care Act (ACA) penalty fees

Last Updatedin Recordkeeping Question of the Week

How to Conduct an Internal I-9 Audit

Last Updatedin HR Compliance, Recordkeeping Question of the Week

What are the Latest ACA Reporting Changes and Deadlines?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

Are Evacuation Drills Mandatory to Meet OSHA Training Requirements?

Last Updatedin Health, Safety & Security, Training & Development Question of the Week

How To Handle Expired Prescription Drug Use In The Workplace?

Last Updatedin Health, Safety & Security, HR Compliance, Training & Development Question of the Week

What Are The Top 5 Commonly Missed Records In Employee Personnel Files?

Last Updatedin HR Compliance Question of the Week

Can I backdate FMLA paperwork?

Last Updatedin Benefits & Compensation, HR Compliance, Recordkeeping Question of the Week

What Do I Have to Know Before Filing My EEO-1 Report?

Last Updatedin Recordkeeping Question of the Week

Can I Store I-9 Forms Electronically?

Last Updatedin HR Compliance Question of the Week

Can We Cut a Live Check to Entice an Employee to Return Company Property?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

How to Handle Background Checks for Temporary Employees

Last Updatedin Recruitment Question of the Week

Mandatory Retirement: Is It Legal?

Last Updatedin Employee Relations, HR Compliance Question of the Week

How To Conduct a Workplace Accident Investigation

Last Updatedin Health, Safety & Security, HR Compliance Question of the Week

Can My Employee Take a Vacation While on FMLA Leave?

Last Updatedin Benefits & Compensation, Employee Relations Question of the Week

Can an Employee Take FMLA Leave to Care for an Adult Child?

Last Updatedin HR Compliance Question of the Week

Why Do I Need An Employee Handbook?

Last Updatedin Communications Question of the Week

Is it Important to Use Consensual Relationship Agreements?

Last Updatedin Employee Relations, HR Compliance Question of the Week

What Laws Apply When Businesses Reach 50 Employees?

Last Updatedin HR Compliance Question of the Week

Who Has to Submit OSHA Form 300A?

Last Updatedin Health, Safety & Security, HR Compliance, Recordkeeping Question of the Week

Marijuana in the Workplace

Last Updatedin Health, Safety & Security Question of the Week

Can you be an Employee and Independent Contractor for the Same Company?

Last Updatedin HR Compliance Question of the Week

How To Handle Drug and Alcohol Abuse in the Workplace

Last Updatedin Health, Safety & Security Question of the Week

Can I Fire Someone During Their Introductory Period?

Last Updatedin Employee Relations Question of the Week

Why Is Harassment Training Important?

Last Updatedin Training & Development Question of the Week

At-Will Employment Termination Risks

Last Updatedin HR Compliance Question of the Week

Do I Need a Heat Safety Plan? How Do I Build One?

Last Updatedin Health, Safety & Security Question of the Week

Federal Employment Poster Requirements for On-Site and Remote Workers

Last Updatedin HR Compliance, Recordkeeping Question of the Week

What is Equal Pay Day?

Last Updatedin Benefits & Compensation Question of the Week

How To Organize Employee Records And Remain Compliant

Last Updatedin Recordkeeping Question of the Week

What is the Value of Job Descriptions?

Last Updatedin Communications, HR Compliance Question of the Week

Why Is It Important To Get An Employee’s Signature?

Last Updatedin HR Strategy, Recordkeeping Question of the Week

Are Employee Gift Cards Considered Taxable Benefits?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

How To Determine If A Home Office Injury Is Covered By Workers’ Compensation

Last Updatedin Health, Safety & Security Question of the Week

Do Our Remote, Out-of-State Employees Qualify for FMLA?

Last Updatedin HR Compliance Question of the Week

Compensating Employees for Travel Time

Last Updatedin HR Compliance Question of the Week

How to Handle Unemployment Fraud?

Last Updatedin Employee Relations Question of the Week

What Should I Consider Before Doing a Reduction in Force?

Last Updatedin Communications, Employee Relations, HR Compliance Question of the Week

What Should Ohio Employers Know About Marijuana in the Workplace?

Last Updatedin Health, Safety & Security Question of the Week

What is a Certificate of Qualification for Employment?

Last Updatedin HR Compliance, Recruitment Question of the Week

Contact Us

Clark Schaefer Strategic HR (CSSHR)

10856 Reed Hartman Hwy

Suite 225

Cincinnati, OH 45242

Clark Schaefer Strategic HR (CSSHR) is recognized by SHRM to offer Professional Development Credits (PDCs) for SHRM-CP® or SHRM-SCP® recertification activities.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice about their particular situation and relevant jurisdiction. This website contains links to other third-party websites. These links are only for the convenience of the reader, user or browser; Clark Schaefer Strategic HR (CSSHR) does not recommend or endorse the contents of the third-party sites.