How Do We Create An Emergency Preparedness Plan?

HR Question:

We don’t have a formalized emergency preparedness plan, and I think we should probably have one, right? What should we include?

HR Answer:

You’re right. Every employer needs an emergency action plan for many reasons, including to be compliant with the Occupational Safety & Health Administration (OSHA) 29 CFR 1020.38(a) requirement. Beyond the mandate, every employer should want to protect their employees from harm to the best of their ability, as emergencies can be unpredictable, scary, and have impacts beyond your business to the community around you – such as the recent explosion at a Northern Kentucky chemical plant. And finally, if you do not protect employees and they are harmed, they may come back with a lawsuit, as was the case after the recent tornados destroyed a local factory in Mayfield, Kentucky.

Emergency action planning doesn’t have to be hard. You should have a written policy to address a variety of potential emergency situations such as a fire, tornado, hurricane, chemical spill or explosion, active shooter, and major illness or pandemic. When prepping Emergency Response Plans, it’s important that you anticipate the variety of emergencies you might face. Consider the risks that your organization may be exposed to, even if they’ve never happened before, and make a list. Create a separate plan for each separate emergency. After all, how you respond to a flood may be very different than how you would respond to a tornado.

From there, it’s important that you prepare your teams. Clearly communicate these plans to all employees at all locations annually and be sure to practice them on a regular basis. At a minimum, the strongest emergency response plans should include:

- A way of making an immediate announcement of an emergency to employees (e.g., PA system, phones, text, etc.)

- Response procedures including emergency escape routes and safe shelter-in-place designated areas (post these routes/locations at common points in the building)

- Identification of a safety officer and/or employees who may remain to perform critical operations before they evacuate/shelter-in-place (depending on the severity of the emergency) and what those operations are

- Accounting for all employees after evacuating or emergency has concluded

- Rescue and medical duties for employees

- Names or job titles of persons who should be notified of the situation

The beginning of a new year is a great time to remind your employees of your emergency action plans and practice them for a variety of situations. Some resources available to assist in developing plans include:

- Strategic HR’s Emergency Preparedness Toolkit

- OSHA’s How to Plan for Workplace Emergencies & Evacuations

- Ready.gov Business Preparedness Planning and Tools

Special thanks to Lorrie Diaz, MS, for contributing to this HR Question of the Week!

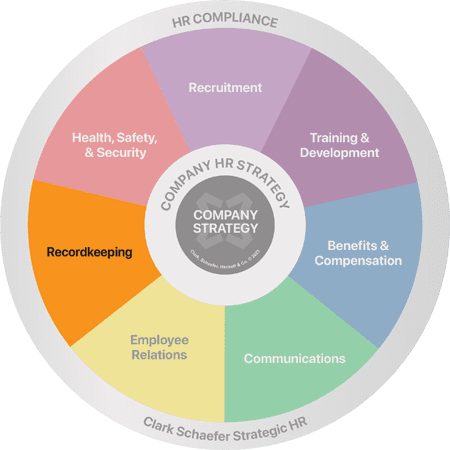

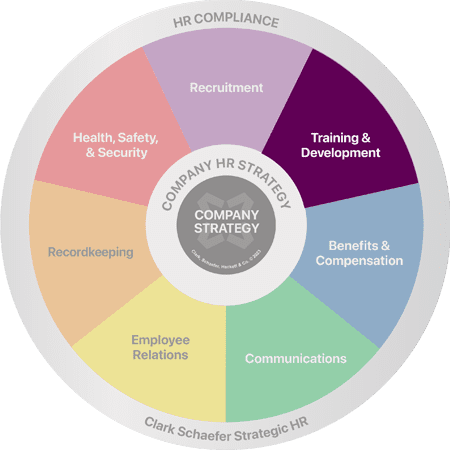

It’s not negative thinking to plan for a devastating event that could harm employees or impact your company’s ability to function – in fact, it’s a good business practice. Bad things happen, but it’s how we prepare for and recover from a disastrous event that often leads to success or failure. Visit our Health, Safety & Security page to learn more about how we can help you with your emergency preparedness needs.