Recordkeeping Questions of the Week

How Long Should We Keep Resumes and Applications?

Last Updatedin Recordkeeping Question of the Week

How Do I Handle Missing or Incorrect I-9 Forms?

Last Updatedin HR Compliance, Recordkeeping Question of the Week

Do I Need a New I-9 Form for a Name Change?

Last Updatedin HR Compliance, Recordkeeping Question of the Week

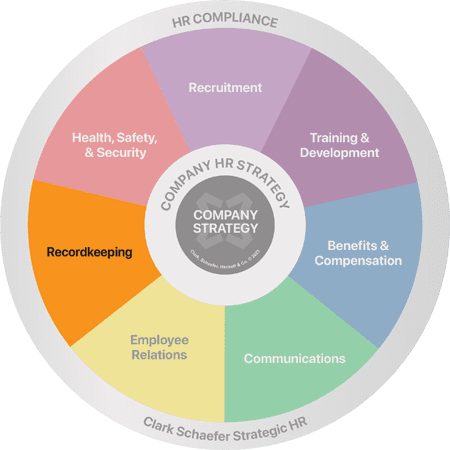

What are the Best HR Practices for the End of the Year?

Last Updatedin HR Compliance, HR Strategy, Recordkeeping Question of the Week

What to do if the IRS notifies you of Affordable Care Act (ACA) penalty fees

Last Updatedin Recordkeeping Question of the Week

How to Conduct an Internal I-9 Audit

Last Updatedin HR Compliance, Recordkeeping Question of the Week

Can I backdate FMLA paperwork?

Last Updatedin Benefits & Compensation, HR Compliance, Recordkeeping Question of the Week

What Do I Have to Know Before Filing My EEO-1 Report?

Last Updatedin Recordkeeping Question of the Week

Who Has to Submit OSHA Form 300A?

Last Updatedin Health, Safety & Security, HR Compliance, Recordkeeping Question of the Week

Electronic Recordkeeping Checklist

Last Updatedin Recordkeeping Question of the Week

Performance Review Copies

Last Updatedin HR Compliance, Recordkeeping Question of the Week

What to Include in a Written Warning

Last Updatedin Recordkeeping Question of the Week

Federal Employment Poster Requirements for On-Site and Remote Workers

Last Updatedin HR Compliance, Recordkeeping Question of the Week

Does A Hospital Overnight Stay Qualify for FMLA?

Last Updatedin Recordkeeping Question of the Week

How To Organize Employee Records And Remain Compliant

Last Updatedin Recordkeeping Question of the Week

Why Is It Important To Get An Employee’s Signature?

Last Updatedin HR Strategy, Recordkeeping Question of the Week

I-9 Forms for Seasonal Employees

Last Updatedin Recordkeeping Question of the Week

Candidate Experience: How Small Tweaks Can Make a Huge Impact

Last Updatedin Communications, Recordkeeping Question of the Week

Avoid Penalties: Maintain a Legal Hiring Process

Last Updatedin Recordkeeping Question of the Week

When To Complete an I-9 for a Rehired Employee?

Last Updatedin Recordkeeping Question of the Week

Hiring Foreign Nationals

Last Updatedin Recordkeeping Question of the Week

An Employee Died Suddenly But Had Not Updated Their Beneficiary

Last Updatedin Recordkeeping Question of the Week

Employee Files

Last Updatedin Recordkeeping Question of the Week

Key Areas of Recordkeeping to Keep Up to Date in the New Year

Last Updatedin Recordkeeping Question of the Week

Disposing of Old Records

Last Updatedin Recordkeeping Question of the Week

Requiring Employee Contact Information

Last Updatedin Employee Relations, Recordkeeping Question of the Week

Managers Maintaining Personnel Files

Last Updatedin Recordkeeping Question of the Week

Contact Us

Clark Schaefer Strategic HR (CSSHR)

10856 Reed Hartman Hwy

Suite 225

Cincinnati, OH 45242

Clark Schaefer Strategic HR (CSSHR) is recognized by SHRM to offer Professional Development Credits (PDCs) for SHRM-CP® or SHRM-SCP® recertification activities.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice about their particular situation and relevant jurisdiction. This website contains links to other third-party websites. These links are only for the convenience of the reader, user or browser; Clark Schaefer Strategic HR (CSSHR) does not recommend or endorse the contents of the third-party sites.