What Employers Need To Know About Michigan’s Earned Sick Time Act (ESTA)

HR Question:

Our company has locations in multiple states, including Michigan, where there’s been a recent change to the Earned Sick Time Act. Can you explain what’s changed and what we, as an employer, need to do to comply with Michigan’s Earned Sick Time Act?

HR Answer:

Yes, this has been an evolving issue. On February 21, 2025, Michigan Governor Gretchen Whitmer signed House Bill 4002 into law, amending the state’s Earned Sick Time Act (ESTA). These changes have significant implications for employers operating within Michigan as they include revisions to accrual rates, carryover rules, and compliance deadlines. Below we’ll outline what Michigan employers should consider moving forward to support their compliance.

Key Provisions of House Bill 4002

House Bill 4002 introduces several critical modifications to the ESTA, including the following four key components:

1. Accrual and Usage of Earned Sick Time

For employers with 10 or fewer employees:

Employees accrue one hour of paid earned sick time for every 30 hours worked, up to a maximum usage of 40 hours per year. Employers have the option to provide 40 hours of paid sick time at the beginning of the year, allowing immediate use.

For employers with more than 10 employees:

Employees accrue one hour of paid earned sick time for every 30 hours worked, with a maximum usage of 72 hours annually. Alternatively, employers can frontload 72 hours of paid sick time at the start of the year.

2. Carryover Provisions

For employers with 10 or fewer employees:

Employees may carry over up to 40 hours of unused earned sick time to the following year.

For employers with more than 10 employees:

Employees can carry over up to 72 hours of unused earned sick time annually.

3. Frontloading Option

Employers choosing to frontload the full allotment of sick time at the year’s start are not required to track accruals or allow carryover of unused time.

4. Effective Dates

The amendments took immediate effect on February 21, 2025. However, small employers with 10 or fewer employees have until October 1, 2025, to comply with the paid earned sick time provisions.

Implications for Employers

Employers in Michigan must assess and adjust their policies to align with the revised ESTA requirements. As you work to support your compliance, consider the following:

- Policy Review and Update: Examine existing leave policies to ensure they meet or exceed the new standards. This may involve revising accrual rates, usage caps, and carryover rules.

- Record-Keeping Practices: Implement systems to accurately track hours worked, sick time accrued, and sick time used. For employers opting to frontload sick time, be sure to have clear documentation of the provided hours and any usage.

- Employee Communication: Inform staff about their rights and responsibilities under the updated sick leave policy. Clear communication helps prevent misunderstandings and ensures employees are aware of how to utilize their earned sick time.

- Budget Considerations: Anticipate the financial impact of providing additional paid sick time, which is especially critical for smaller businesses with limited resources. Planning ahead can help mitigate potential budgetary constraints.

- Compliance Timeline: While the law is already in effect, small employers have until October 1, 2025, to implement the necessary changes. It’s crucial to use this time effectively to be better positioned to comply by the deadline.

Supporting Your Organization’s Compliance

To navigate these changes successfully, we encourage employers to:

- Consult Legal Counsel: Seek advice to understand the specific implications of House Bill 4002 on your organization and to ensure that policy revisions comply with the law.

- Train Management Personnel: Educate supervisors and HR staff about the new requirements to support consistent and fair application across the organization.

- Monitor Legislative Updates: Stay informed about any further modifications or guidance related to the ESTA to best support your ongoing compliance.

By proactively addressing these areas, employers can align with Michigan’s updated Earned Sick Time Act, thereby supporting their employees’ well-being and compliance.

Special thanks to our CSH colleague, Luke Downing, Shareholder, for sharing his expertise in this HR Question of the Week.

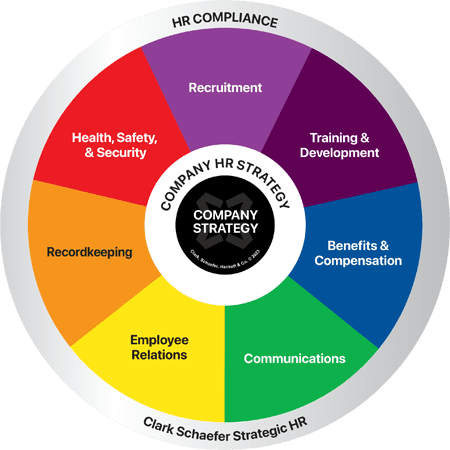

It can be overwhelming to stay on top of constantly changing employment regulations, but you don’t have to do it alone. The HR experts at Clark Schaefer Strategic HR are prepared to support all of your HR Compliance needs. For example, we can create, review, or revise your employee handbook to help you communicate important changes to your employees while also supporting your compliance. Interested? Request a free handbook consultation.

HR Question:

HR Question: