Low Cost Benefit Ideas

Last Updated on November 22, 2022 / Benefits & Compensation

Question:

We are a small business trying to attract and retain staff in this competitive job market. We can only offer so much in compensation. Are there any low-cost benefit ideas you can recommend?

Answer:

With unemployment levels at a record low, attracting and retaining talent is extremely hard regardless of the size of your business. But, you are on the right path to be thinking about the benefits you offer in addition to compensation. In a recent Workforce Report by AFLAC, over half of employees (55%) say they are at least somewhat likely to take a job with slightly lower pay but a more robust benefits package.

Many people often think of the traditional medical, dental, vision, and retirement plans as the cornerstones of benefits offerings, but your benefits can reach far beyond this list. To stimulate your brainstorming process of benefit opportunities, take a look at our article featuring the Top 10 Benefits of 2019. Some of the most popular lower-cost options that we found in our research included:

- Flexible Working Options – This can include working remotely and flexible scheduling.

- Professional and Career Development – This can be accomplished through reimbursement of professional development memberships and offering internal and external training and mentorship opportunities.

- Unlimited PTO – This could allow employees to take as many vacation, sick, and mental-health days as they need, as long as they meet their performance goals.

- Free Food and Beverages – These on-site perks encourage mingling and an easy way to refuel and recharge.

- Ancillary Benefits – Some examples include Teledoc, employee assistance programs, legal assistance, and identity theft protection.

- Health & Wellness – These can range from options that support physical wellness (i.e., gym membership reimbursements, on-site exercise classes, coordinating company teams for 5K run/walk, etc.) to ensuring financial wellness (i.e., financial planning training and support).

So, what benefits should your organization offer? The secret answer to your question is…”Ask your employees.” Every organization is different, and what works in one organization doesn’t necessarily work in the next. Just because a particular benefit works for Disney, Southwest Airlines, Zappos, or the company next door, it doesn’t mean it will work for your organization. Far too often, employers assume they know what employees want, but their assumptions could not be further from the truth.

Your best way to determine the perceived value of your benefits is to simply ask your employees. Gathering employee feedback can be done in many ways, ranging from having a casual conversation with your employees to conducting focus groups or a formal survey. You’ll want to choose the method that fits your organization best.

Questions to consider asking include:

- How satisfied are you with each of the company benefits?

- Which of our benefits are most important to you?

- Which of our benefits are least important to you?

- How satisfied are you with our current benefits?

- Are there benefits you’d like to see implemented?

- How do you consider our benefits compared to those offered by other companies?

- How interested would you be in the following benefits? (Provide a list of new options for which you’d like to gauge interest.)

With some of the questions above, you’ll want to include a list of your current benefits and provide a Likert scale for your employees to rate their answers. You may find some of the benefits you think your employees love are not important to them at all and are costing you quite a bit of money. Having this knowledge gives you the opportunity to reallocate your dollars toward benefits that will help you to both attract and retain talent.

As you review your benefits with your employees, you may find not all of them know what you offer. By simply asking your employees, it gives you an opportunity to market your benefits to your employees. To ensure that your employees have a solid understanding of the benefits that you offer, we recommend that you provide the following:

Benefits Summary:

If you don’t already have one, consider creating a benefits summary that lists each of your benefits, eligibility, and cost. This tool can be shared with employees and used as a recruitment tool during your hiring process.

Total Compensation Statements:

Develop total compensation statements for your employees that include all of the costs that your organization covers on behalf of the employees, such as compensation, bonuses, employer contributions on premiums, retirement match, taxes, etc.

Benefits Marketing:

Your job doesn’t end by identifying and setting up the benefits for your employees. You will need to regularly update employees on your benefits. What tools do you already have that you can take advantage of (i.e., employee newsletter, bulletin board, company-wide meetings, huddles, etc.)? We do not recommend a one and done approach, rather, you will need to continually share information to keep your organization’s benefits top of mind for your employees.

As a smaller business, you may not have the funds to lead the market in compensation or provide 100% employer-paid health. However, if you know what your employees want, the funds you are able to afford can be better allocated to the benefits your current and future employees want.

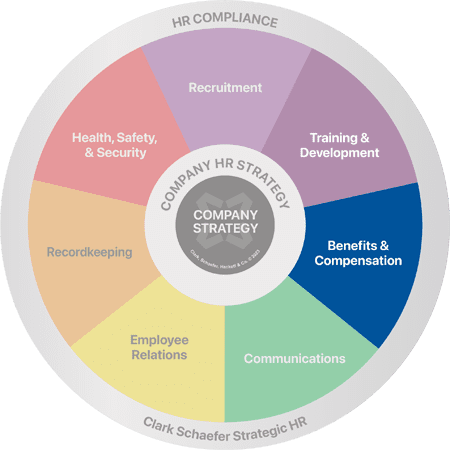

Providing adequate Benefits and Compensation for your employees is key to the recruitment and retention of a well performing workforce, and having the right policies in place can make or break a company. Strategic HR understands this critical need and can conduct a benefits analysis of your current offerings and make recommendations to help you to meet today’s competitive market. Please visit our Benefits and Compensation page for more information on how we can help get you competitive today.