Are Wellness Program Incentives Taxable?

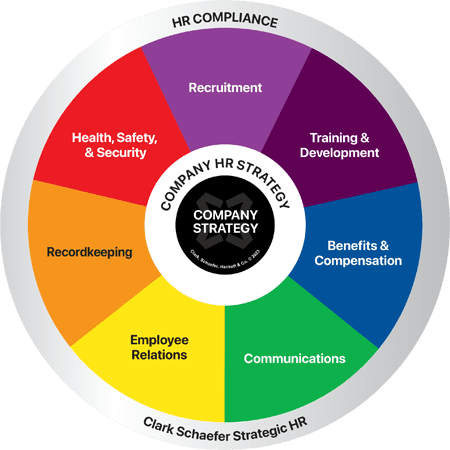

Last Updated on October 3, 2022 / Benefits & Compensation

Question:

Is it true that employees have to pay taxes on wellness program incentives?

Answer:

With wellness programs on the rise, there is plenty of opportunity for employees to receive various incentives – from t-shirts and event tickets to gift cards and cash. As employers consider wellness program design and how to incentivize employees (if at all), they should keep in mind that many wellness program incentives are not excluded from income tax. Does that gift card Johnny received for participating in a wellness program need to be included in his gross income? Per the IRS, yes.

Cash and non-cash incentives, rewards, and payments paid through an employer wellness program are not excluded from an employee’s taxable income (see IRS Memorandum 20162031) and should be included on the employee’s W-2 and subject to federal tax withholdings. For example, non-cash incentives subject to taxation include discounts on products/services and certain merchandise prizes. More specifically, the employee’s gross income includes:

- Employer-provided cash rewards and nonmedical care benefits for participation in a wellness program; and

- Reimbursements of premiums for participating in a wellness program if the premiums were originally made by salary reduction through a Section 125 plan.

Note that employer contributions to an HSA, reduced major medical plan premiums, and benefits and services that are medical care (e.g., biometric screenings, smoking cessation programs, and health risk assessments) are generally excluded from an employee’s gross income and are not subject to taxation. Also, certain benefits may fall into an exception through the “de minimus” rule, defined as the value being so small as to cause accounting of it to be unreasonable or impracticable. However, employers should note that cash rewards are never considered “de minimis”. A practical example of a wellness reward that would be considered “de minimis” is a t-shirt.

Special consideration should be given to the incentives provided as part of your wellness program. Failure to report wellness cash and cash-equivalent incentives can cause significant penalties, including reporting penalties assessed per employee per W-2. In addition, employee relations issues could result as the IRS can pursue employees who received, but never paid taxes on, such incentives.

Clark Schaefer Strategic HR (CSSHR) has the answers to all of your tough Benefits and Compensation related questions. Please visit our Benefits & Compensation page for more information.