What Should Ohio Employers Know About Marijuana in the Workplace?

Question:

As an Ohio employer, can you help me understand how marijuana legalization fits into our employment policies?

Answer:

You are not alone in trying to navigate the everchanging state of marijuana legalization. A growing number of states have either passed laws, or are considering legislation, to ease restrictions on employees’ use of marijuana for medicinal or recreational reasons. So, employers that need or want to continue testing or disciplining for marijuana use must know the applicable state and federal laws, including the court decisions that interpret those rules.

Medical marijuana was legalized in Ohio in September 2016, and retail sales began on January 16, 2019, when the first four licensed dispensaries opened for business. As of February 1, 2020, OHDispensaries.com reports 48 of the 57 licensed dispensaries are operating. So, it is important that you know your rights as an Ohio employer regarding medical marijuana.

Below, we will walk you through some commonly held perceptions and workplace scenarios to help your Ohio-based company evaluate how marijuana legalization impacts your employment policies.

True or False: Medical marijuana users have job protections in Ohio due to state disability discrimination laws.

Answer: False. Presently, there is nothing in Ohio’s medical marijuana law that prohibits or limits an employer’s right to drug test employees for marijuana, require a drug free workplace, or impose discipline or discharge an employee violating an employer’s policies The law protects the employer’s right to fire or discipline any employee found to be using medical marijuana. The statute also states that it will not interfere “with any federal restrictions on employment” related to the use of medical marijuana in the workplace. All marijuana use, whether for medical or recreational use, is still illegal under federal law. It is listed as a Schedule I drug under the Controlled Substances Act, which means that it is deemed to have no medical value and a high potential for abuse.

True or False: If an employee has a medical condition that requires the use of medical marijuana, I must accommodate the employee.

Answer: False. In outlining employers’ rights, Ohio’s Revised Code 3796.28 states that an employee has no specific protections. Under the law, you do not have to accommodate an employee’s need to use the substance. An employer has the right to not hire an employee based on medical marijuana use, possession, or distribution. The law does not allow a cause of action against an employer if an employee believes he or she was discriminated against due to medical marijuana use. An employer is allowed to have a zero-tolerance drug free policy in place, with or without special accommodations for those who use medical marijuana.

True or False: My company has its headquarters in Ohio but has locations in other states. Even if the laws in those states provide workplace protections for medical marijuana users, our employees in those states who use medical marijuana may be disciplined, fired, or not hired.

Answer: False. Thirty-three states and Washington, D.C., have legalized medical marijuana use, and 10 states have approved both medical and recreational use. Registered medicinal users—or “cardholders”—in some states other than Ohio may have job protections. For example, beginning in 2020, employers in Nevada and New York City cannot consider positive pre-employment marijuana screens. However, some exceptions apply, particularly for safety-sensitive positions. Consider research published last year by the National Institute on Drug Abuse where they found that employees who tested positive for cannabis had: 55 percent more industrial incidents, 85 percent more injuries and 75 percent greater absenteeism compared to those who tested negative.

State statutes with nondiscrimination provisions for medicinal use typically exclude jobs that require drug testing under federal law. For example, certain commercial motor vehicle operators would be excluded from job protections because the Department of Transportation requires them to pass drug and alcohol screens.

While Ohio law provides employers with employment rights on the topic of medical marijuana use, HR professionals must remain vigilant to ensure that your company does not act irresponsibly or apply policies in a discriminatory manner. Make sure that your drug-testing practices and drug-free workplace policy fall within the parameters of the laws in the states in which your company operates. You may find it helpful to consult your legal counsel to ensure that you understand and comply with the federal, state and local laws that may apply to your organization.

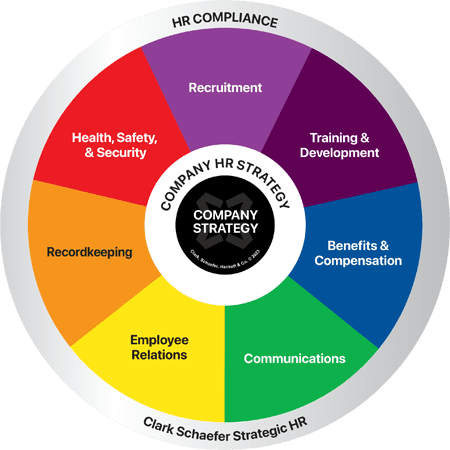

Strategic HR knows that keeping abreast of workplace compliance issues and deadlines can be daunting, especially when the laws keep changing. We can help you by offering resources to help you identify and mitigate compliance issues and by making sure you are informed of changes and reacting in a timely manner. Our HR Audit will help your organization identify trouble spots in your HR function. Visit our HR Audit page to learn more about this helpful service.