What Are Non-Qualified Bonus Grant Programs?

Last Updated on August 17, 2022 / Benefits & Compensation

HR Question:

Like any organization, I have a handful of key employees – my “rockstars,” for lack of a better term. If any of them left, it would be difficult to replace them – not to mention the impact it would have on our company’s success. But I’m struggling to keep up with the pay increases that other companies can afford. I need to find a way to retain and compensate these key employees and someone suggested non-qualified bonus grant programs. What are those?

HR Answer:

This is a great question. Not every company can afford to meet the wage increases of 10, 15, or even 20% that seem to be commonplace in today’s competition for talent. It might even seem like competitors are able to pay whatever it takes to recruit key employees away from their current employer. Or if employees are willing to forego a higher salary for other benefits, like stocks or buying into company ownership, but that’s not an available option, what are employers to do? One way that employers can financially reward essential employees over a longer time period (and thus, encourage retention) is through Non-Qualified Bonus Grant Programs.

What are Non-Qualified Bonus Grant Programs?

Non-Qualified Bonus Grant (NQBG) programs were specifically built for employers in need of long-term incentives for key employees when other financial benefits (like stocks, ownership, or commissions) aren’t available. By establishing a vesting period, employers are able to set up key employees to receive additional compensation should they stay employed and perform well over that period of time.

At the end of each year, the employer reviews how the company and employees have performed. From there, a bonus amount for the employee is determined. The amount that is credited is fully discretionary and controlled by the employer, meaning that should an employee not perform as agreed upon during a given year, the bonus amount can reflect that.

What are the Benefits of an NQBG Program?

This can be a fantastic retention tool in more ways than one. First, this program allows employees to defer compensation, creating guaranteed income for the future.

Second, this gives employers an opportunity to reward those can’t-do-without employees for their loyalty. The year-end review also provides employers a chance to review this benefit with the employee and have a tangible result of the employer’s appreciation. NQBGs provide additional benefits to employers in that they are:

- Simple to execute

- Inexpensive

- Flexible based on the business’s needs

Additionally, these programs, along with other non-qualified deferred compensation plans, aren’t covered under the Employee Retirement Income Security Act, meaning that there are no regulations when it comes to who the employer can or has to include in the program’s benefits.

NQBG plans can benefit the bottom line, as the compensation that employees are earning now isn’t payable until the future. The only drawback for the employer is that the funds aren’t tax-deductible for the organization until they are paid out.

It is no secret that employers are having to navigate through a competitive labor market making it even harder to retain their most critical talent. There’s no better time to look for creative and financially viable ways to reward and retain your essential employees. It may be worth exploring if a Non-Qualified Bonus Grant Program could be a valuable retention tool for your organization.

Special thanks to Brian Leen of LS Benefits for sharing his expertise on popular retention tools like NQBG programs!

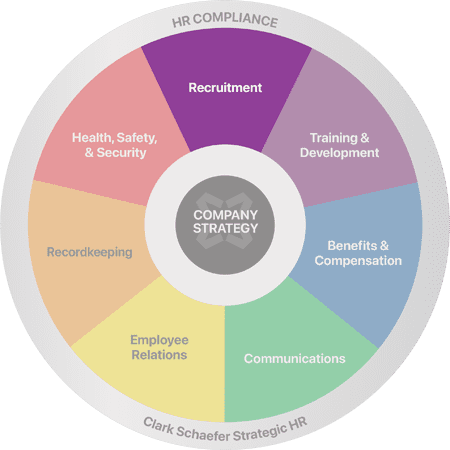

Strategic HR offers assistance with a variety of Benefits and Compensation needs, including understanding how recruitment trends affect your business and helping you to craft competitive compensation plans. Please visit our Benefits and Compensation page for more information.