Who Is Responsible to Provide COBRA Coverage to M&A Qualified Beneficiaries?

Last Updated on October 31, 2023 / Benefits & Compensation

(By Diane Cross, Compliance Analyst at HORAN. Reposted from HORAN’s Health Benefits Compliance Blog)

HR Question:

Business reorganizations, such as mergers and acquisitions (M&A), directly impact employee benefits administration – and one consideration is COBRA responsibility. What is our COBRA responsibility as a result of our business sale (or purchase)? is a common question we receive from employers.

HR Answer:

The short answer is, it depends on the circumstances, discussed further below.

Who is Responsible to Provide COBRA Coverage to M&A Qualified Beneficiaries?

A seller and buyer may contractually allocate COBRA responsibility as part of the transaction. If that is the case, COBRA responsibility will be outlined by the terms of the contract. In absence of contracted terms, or if the party who was contractually responsible for providing COBRA fails to do so, the IRS provides guidelines that outlines who has COBRA responsibility. Generally, if the seller maintains any group health plan after the transaction, the seller bears responsibility for providing COBRA coverage to the M&A qualified beneficiaries.

Who are M&A qualified beneficiaries?

For the purposes of COBRA, M&A qualified beneficiaries include (1) individuals who are receiving COBRA coverage under the seller’s group health plan at the time of the transaction; and (2) individuals who experience a loss of coverage due to a qualifying event in connection with the transaction.

If the seller does not maintain any group health plan after the sale, who bears COBRA responsibility will depend on the structure of the transaction. In a stock purchase (the buyer assumes the role of the seller and generally assumes responsibility for all the seller’s employee benefit plans as a matter of law), the buyer is responsible for providing COBRA coverage to M&A qualified beneficiaries. However, in an asset purchase (buyer usually does not assume any plans or plan liabilities unless a buyer affirmatively adopts or continues the seller’s plans), buyer is responsible for providing COBRA coverage to M&A qualified beneficiaries only if the buyer maintains a group health plan and is considered a successor employer.

When is a buyer a successor employer?

A buyer is a successor employer if it continues the operations of the business without substantial change or interruption, and the seller does not provide any group health plan after the transaction.

Why is this Important?

Aside from employers understanding their COBRA responsibility generally, the impact of COBRA liability for M&A beneficiaries could be significant. For example, a buyer assuming COBRA liability could result in a negative impact to the buyer’s premiums; for a self-funded plan, a buyer assuming COBRA liability can impact the plan’s finances especially if M&A beneficiaries have high claims expenses. Such issues, if determined early enough in the process, could be factored into negotiations (through the purchase price or handled another way by agreement).

When negotiating the purchase or sale of a business, employers should be mindful to include COBRA considerations early in its due diligence and discuss with counsel to understand any potential responsibility. Please contact your HORAN representative with questions.

Thank you to HORAN for providing the content for our Question of the Week. HORAN serves as a trusted advisor on employee benefits, wealth management and life and disability insurance. To learn more about HORAN, please contact HORAN for additional information.

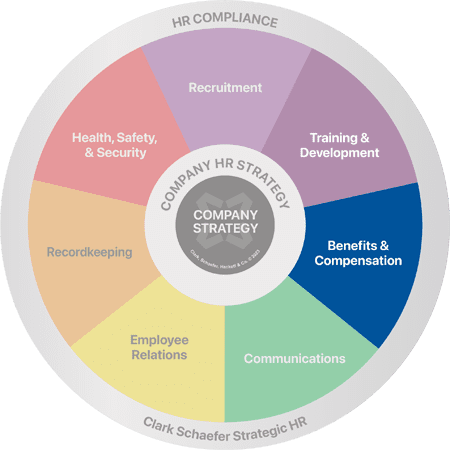

Strategic HR is ready to assist you with any of your challenging situations around Benefits and Compensation. We offer assistance with everything from job descriptions to policy development to help address your difficult issues that impact employee compensation or benefits. Please visit our Benefits and Compensation page for more information on how we can assist you.