Can you be an Employee and Independent Contractor for the Same Company?

Last Updated on October 31, 2023 / HR Compliance

HR Question:

Can an individual that is working for us be both an employee AND an independent contractor?

HR Answer:

According to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor. For example, it is possible that an individual could work part of the year as an employee and part of the year as an independent contractor due to a layoff or even a resignation. Another way this could occur would be if the individual is performing completely different services or duties for a company that would qualify them as an independent contractor.

Examples of Employee and Independent Contractor Dual Classification

- A production worker is laid off due to a slow down in the warehouse. The individual begins doing janitorial work for a few local companies and provides services to the same company from which they had been laid off. In this situation, the individual would receive a W-2 for the time they worked as an employee and a 1099 for the janitorial work.

- An Executive Assistant who also owns a cleaning service business can have dual classification if their employer contracts with their cleaning company to clean the offices in the evenings.

- An IT Help Desk Associate who performs graphic design work as a side gig can have dual classification if their employer contracts with the individual to create a new logo for the company.

- An Electrician who also does handy work after hours in the community can have dual classification if the individual contracts with their employer to replace the company’s roof.

- A custodian who works for a county public school and also owns and operates his own snow plowing service on nights and weekends can be classified as an employee and issued a Form W-2 for his custodian position. At the same time, when the county contracts with the individual for snow plowing services, he is an independent contractor as well.

How to Determine if Someone is an Employee or Independent Contractor

To determine if this dual classification applies to your situation, you must first verify if your current (or previous) employee’s secondary work qualifies as an independent contractor. The IRS provides specific guidance surrounding the Independent Contractor Definition.

As an alternative to making the determination yourself, you can choose to have the IRS review your situation and make the determination for you, but it will take some time. You would need to submit your position information to the IRS directly by completing IRS Form SS-8. In doing this, the IRS will determine the proper job classification and even guide you on dual classification. Although you will be confident in using the correct classification by following this route, know that the average response time is estimated to be six months.

If you (or the IRS) determine that the extra work being completed meets the Independent Contractor guidelines, you can pay them as both an employee and an independent contractor. If you elect to do this, be sure to keep accurate records. Companies should maintain a W-4 for employees and a W-9 for those working as a contractor. In addition, be sure to clearly and accurately document the hours worked in each category and the duties that were performed. It is widely believed that having a worker receive both a W-2 and a 1099 increases the likelihood of an audit by both the IRS and the DOL. Therefore, maintaining detailed records will be essential for your defense.

What Happens if you Misclassify Employees

Criminal penalties and liability for backpay may be imposed against organizations and leaders if Fair Labor Standards Act (FLSA) laws are violated. The DOL has recently increased its focus and scrutiny on employer misclassification of independent contractors. It is important to be aware that additional auditors have been engaged to direct their attention toward this area of compliance. Therefore, be sure that you have followed all relevant guidelines and maintain proper recordkeeping to protect your organization and remain compliant.

Thank you to Patti Dunham, MBA, MA, SPHR, SHRM-SCP for updating this HR Question of the Week.

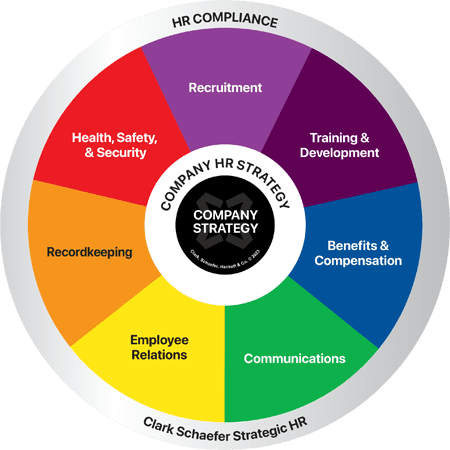

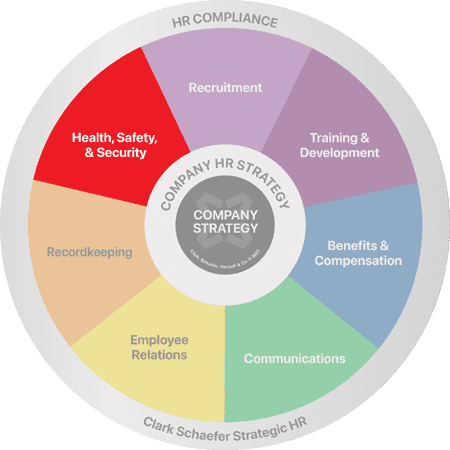

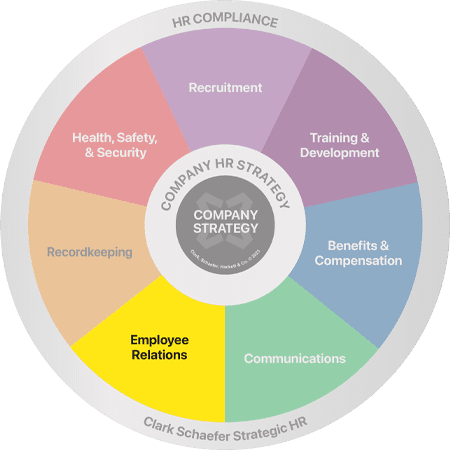

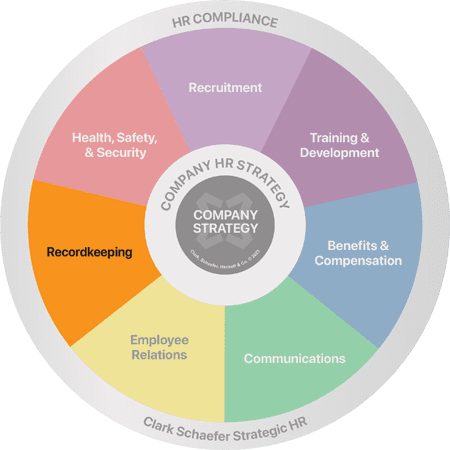

Strategic HR knows that keeping abreast of HR Compliance issues can be daunting, especially when the laws keep changing. We can help you stay compliant by fielding your questions regarding properly classifying your employees and other HR matters. We offer resources to help you identify and mitigate compliance issues. Visit our HR Compliance & Recordkeeping page to learn about our auditing services which can help you identify trouble spots in your HR function.