What Are Total Compensation Statements?

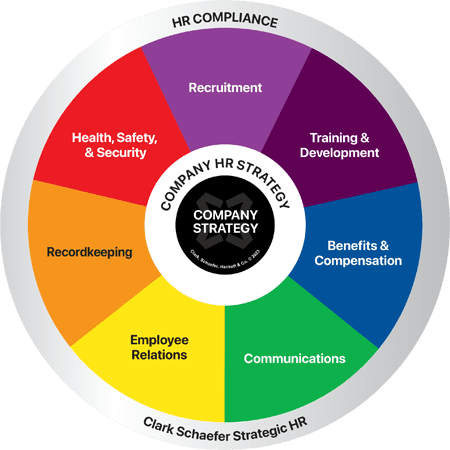

Last Updated on September 26, 2023 / Benefits & Compensation

HR Question:

Can you explain Total Compensation Statements … What are they? What should they include? When should we use them?

HR Answer:

Total Compensation Statements convey the total value of your compensation and benefits offerings as they include an employee’s direct and indirect compensation. They are a great tool to show not only how much an employee earned in base salary or hourly wages and bonuses in a given time period (often a year), but they also share the hidden costs of employee benefits and perks. Employers prepare and distribute Total Compensation Statements to employees typically once a year, often at the end of the year or with their W-2.

Total Compensation Statements should include the employer’s cost for the following:

- Social Security & Medicare taxes

- Workers’ compensation

- Unemployment tax

- ALL insurance packages (health, dental, vision, life, short- & long-term disability, long term, etc.)

- HSA, FSA, HRA contribution

- Retirement contributions

- Paid time off (vacation, sick, holidays, personal, bereavement, jury duty)

- EAP, wellness, or financial health programs

- Relocation

- Parking

- Tuition reimbursement & education assistance

- Professional memberships

- Professional development and training (internal and external)

- Company vehicle or equipment use

- Company events, lunches, celebrations

How to use Total Compensation Statements to RETAIN your employees

Although you are not required to provide them, we highly recommend that you distribute Total Compensation Statements to your employees. If you are not using them as an essential retention tool, you are missing out on the benefits of sharing the secret value of your employees’ “total” paycheck with them. Most employees have no idea how much it costs to employ someone and have an expectation of benefits without understanding the cost. Seeing these numbers is where the real aha moments come for employees!

Consider providing a Total Compensation Statement to your employees at the end of this year, or maybe even more than once a year. The statement provides a great reminder of the many benefits and the additional dollars you are investing in them beyond what they see in their paycheck, especially if they are thinking about joining the “Great Resignation.” As employees quit their jobs in record numbers, according to USA Today, this Total Compensation Statement may be the message that conveys that you, their employer, care about them and provide benefits that go beyond the organization’s front door to provide for their health, education, retirement, etc.

How to use them to RECRUIT new employees

I recently attended a local event where Sheetz, a ‘new to our area’ gas station/convenience store/fast food restaurant, was handing out free cookies, drawing in the crowd with sugar, and recruiting fliers. What caught my eye was not another flyer for another job, rather a flyer showcasing what you could earn working at the company in terms of Total Compensation. That total number was big and bold right at the top and included their base pay, benefits, and retirement contributions. The flier also showed how an employee could progress through their four employment levels and each level showed the total compensation in bold at the top. You immediately saw that you could earn $31,166 per year (rather than $10.60 an hour base pay). What a great way to stand out and catch the eye of job seekers!

Thank you to Lorrie Diaz, Senior HR Consultant with Strategic HR, for contributing to this HR Question of the Week.

Need assistance in creating a Total Compensation Statement? Strategic HR will work with your organization to develop a great strategy for using Total Compensation to recruit and retain your talent and even create the statements for you. Contact us to get started!