FLSA Safe Harbor Provision

Question:

I keep hearing people reference the “safe harbor” provision of the Fair Labor Standards Act and that I should have language included in my handbook about it. What is the FLSA Safe Harbor Provision?

Answer:

Under the old FLSA provisions (pre-2004), if an employer made an improper deduction from an exempt employee’s salary, the employee would lose their exempt status and the employer would be required to treat not only the impacted employee but EVERYONE with the same title as though they are non-exempt. Under the current FLSA rules, if an employer makes an improper deduction but follows the safe harbor provisions, they can correct the error but the employee and those with the same title DO NOT lose their exempt status.

To meet the requirements of the safe harbor provisions, the employer must do the following:

- Establish a clearly communicated policy prohibiting improper deductions and including a complaint mechanism;

- Reimburse employees for any improper deductions in a reasonable time frame; and

- Make a good-faith commitment to comply in the future.

This does not protect employers who are frequent abusers but does allow a safety net to those who made the deduction in error. Employers should create a safe harbor policy and communicate it to employees through the employee handbook. For additional information, go to the Department of Labor website and review their safe harbor policies on the FLSA page.

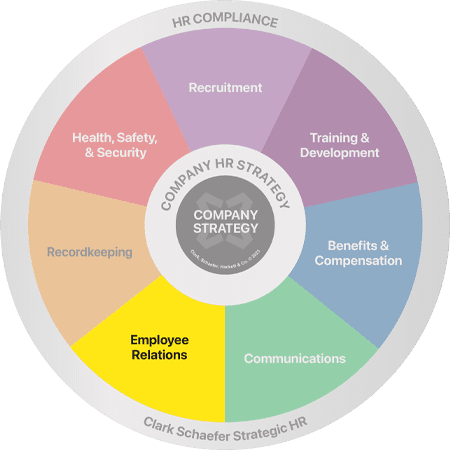

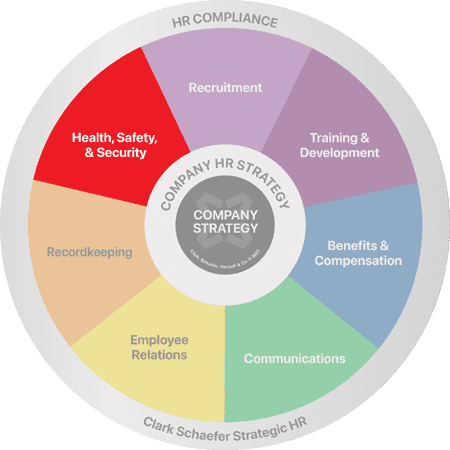

It’s tough having to navigate the ever-changing FLSA laws and other federally mandated rules and regulations. Strategic HR can help. Ask us for assistance with any of your benefits and compensation needs. Please visit our Benefits & Compensation page for more information on any of these services.