Posts

What Role Should HR Play in Benefits Open Enrollment to Ensure Success?

Last Updatedin Benefits & Compensation Question of the Week

How To Follow ACA Reporting Requirements & Avoid Penalties

Last Updatedin HR Compliance Question of the Week

What is HR’s Role in the Mergers & Acquisitions Process?

Last Updatedin HR Strategy Question of the Week

Employee Benefits Trends 2025–2026: Attracting Top Talent

Last Updatedin Benefits & Compensation Question of the Week

How To Set Up An Employee Bonus Plan

Last Updatedin Benefits & Compensation Question of the Week

How Can I Support Employee Well-Being Beyond the EAP?

Last Updatedin Employee Relations, Health, Safety & Security Question of the Week

What Employers Need To Know About Michigan’s Earned Sick Time Act (ESTA)

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

How Can I Use Salary Benchmarking As a Recruitment Strategy?

Last Updatedin Benefits & Compensation, Recruitment, Videos Question of the Week, Video

How to Manage Creditable Coverage Reporting and Notices

Last Updatedin HR Compliance Question of the Week

Do I Have to Give Performance Bonuses to Employees on FMLA Leave?

Last Updatedin Benefits & Compensation Question of the Week

What are the Best HR Practices for the End of the Year?

Last Updatedin HR Compliance, HR Strategy, Recordkeeping Question of the Week

What to do if the IRS notifies you of Affordable Care Act (ACA) penalty fees

Last Updatedin Recordkeeping Question of the Week

What are the Latest ACA Reporting Changes and Deadlines?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

What Are The Top 5 Commonly Missed Records In Employee Personnel Files?

Last Updatedin HR Compliance Question of the Week

Can I backdate FMLA paperwork?

Last Updatedin Benefits & Compensation, HR Compliance, Recordkeeping Question of the Week

Can We Cut a Live Check to Entice an Employee to Return Company Property?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

Can My Employee Take a Vacation While on FMLA Leave?

Last Updatedin Benefits & Compensation, Employee Relations Question of the Week

How Can We Address Pay Compression?

Last Updatedin Benefits & Compensation Question of the Week

What Laws Apply When Businesses Reach 50 Employees?

Last Updatedin HR Compliance Question of the Week

What Are Total Compensation Statements?

Last Updatedin Benefits & Compensation Question of the Week

HR’s Role During An Economic Crisis

Last Updatedin HR Strategy Question of the Week

What is Equal Pay Day?

Last Updatedin Benefits & Compensation Question of the Week

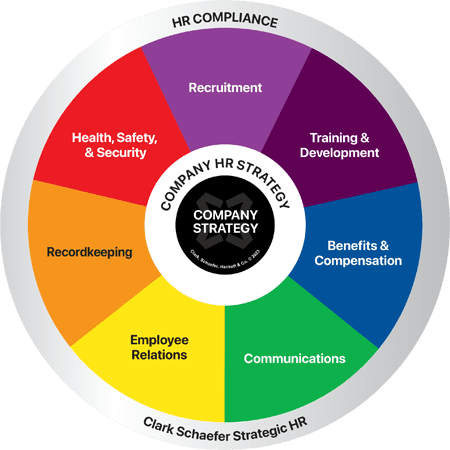

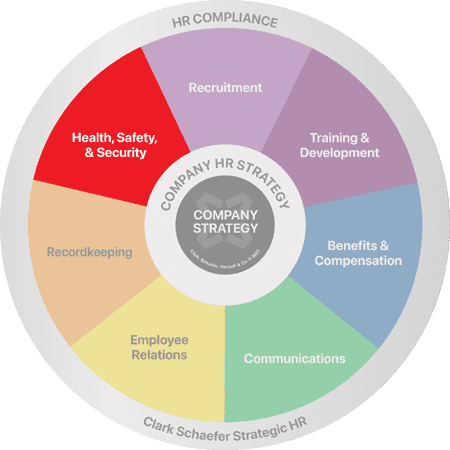

Do I Need HR?

Last Updatedin HR Strategy Question of the Week

Could Sabbaticals Be Your Next Retention Tool?

Last Updatedin Benefits & Compensation, Employee Relations Question of the Week

Who’s Using Your EAP

Last Updatedin Health, Safety & Security Question of the Week

Work-Life Balance Has Become Work-Life Integration

Last Updatedin Employee Relations Question of the Week

Are Employee Gift Cards Considered Taxable Benefits?

Last Updatedin Benefits & Compensation, HR Compliance Question of the Week

How To Determine If A Home Office Injury Is Covered By Workers’ Compensation

Last Updatedin Health, Safety & Security Question of the Week

Mental Health Concerns in the Workplace

Last Updatedin Benefits & Compensation, Health, Safety & Security, HR Strategy Question of the Week

Do Our Remote, Out-of-State Employees Qualify for FMLA?

Last Updatedin HR Compliance Question of the Week

Bonus Grants: A Creative Way to Retain and Reward Key Employees

Last Updatedin Benefits & Compensation Question of the Week

Does My Company Need an AED?

Last Updatedin Health, Safety & Security Question of the Week

What Should I Consider Before Doing a Reduction in Force?

Last Updatedin Communications, Employee Relations, HR Compliance Question of the Week

What Should Ohio Employers Know About Marijuana in the Workplace?

Last Updatedin Health, Safety & Security Question of the Week

Contact Us

Clark Schaefer Strategic HR (CSSHR)

10856 Reed Hartman Hwy

Suite 225

Cincinnati, OH 45242

Clark Schaefer Strategic HR (CSSHR) is recognized by SHRM to offer Professional Development Credits (PDCs) for SHRM-CP® or SHRM-SCP® recertification activities.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice about their particular situation and relevant jurisdiction. This website contains links to other third-party websites. These links are only for the convenience of the reader, user or browser; Clark Schaefer Strategic HR (CSSHR) does not recommend or endorse the contents of the third-party sites.