Summary of Benefits Coverage

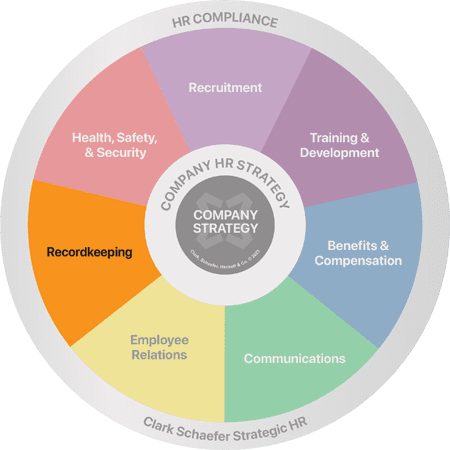

Last Updated on November 28, 2017 / Benefits & Compensation, Communications, HR Compliance

Question:

It sounds like the Health Care Reform is requiring employers to distribute Summary of Benefits Coverage documents for plan years beginning September 23. What do I need to know?

Answer:

You are right! Starting September 23, the Accountable Care Act (aka Health Care Reform) requires employers to distribute the new Summary of Benefits Coverage (SBC’s) documents.

At first glance, the SBC’s seem like an easy task to check off your to-do list. Most health care vendors are filling in the government-designed templates for their clients. All you have to do is hang them on your site or mail to employees. Easy, right?

Well, not so fast.

Since we create and maintain Summary Plan Descriptions for our clients, many have asked us to review the SBC documents sent to them by their vendors. We have found some vendors are providing base documents, but are not including the specific nuances designed into the plans.

When you get your SBC’s, closely check some of the following areas:

- Penalties: If you have penalty fees, e.g. for not pre-certifying a hospital stay, the fees need to be in the Limits and Exceptions box on the same line where the coverage is listed.

- Limitations: If your plan has unique limitation amounts, e.g. for speech and physical therapy or home health and hospice service, make sure they are listed correctly, again on the same line where the coverage is listed.

- Prescription carve outs: If your prescription coverage is carved out from your medical plan, your medical vendor probably won’t complete that section. You will need to complete that part of the template and ask your prescription vendor to review it for accuracy.

For the initial year, the Department of Labor has indicated it wants to work with plans to get to compliance and is not focusing on imposing penalties. Therefore, you might not be concerned about meeting every regulation spelled out in the government’s 15-page instructions. However, keep in mind that you will probably pick up the same document next year, so it would probably be worth the time and effort to get it as accurate and complete as possible. As is true with most benefits and HR communications, the devil is in the details.

A special thanks to Elizabeth Borton, President of Write On Target, for sharing her expertise with us. Sign-up on her website at to receive future communication blogs at www.writetarget.com. Or, you can contact her with questions at EBorton@WriteTarget.com or 937.436.4565 at extension 28.

Are you hesitant when it comes to navigating federally mandated rules and regulations? Strategic HR understands your uncertainty. Ask us for assistance for any of your benefits and compensation needs. Please visit our Benefits & Compensation page for more information on any of these services.