As Open Enrollment Season Approaches, What Are Best Practices to Improve Benefits and Remain Compliant?

Last Updated on September 14, 2022 / Benefits & Compensation

HR Question:

It’s almost that time again – open enrollment season is quickly approaching! I want to be prepared this year and avoid any last-minute decisions or chaos. Can you recommend any best practices for reviewing, improving, and staying compliant with our employees’ health and well-being?

HR Answer:

It can be an intimidating feeling to see Open Enrollment season coming up on the calendar. Health insurance carriers typically provide an annual renewal timeframe and a deadline for brokers and employers to decide on which health insurance carrier will be utilized for the following year. Mapping out your strategy with this deadline in mind guarantees you have ample time to review your options and make effective decisions. In this article, we will walk you through key considerations you should consider as you review your employee benefits package to ensure you are well prepared and compliant with your open enrollment.

Timing of Open Enrollment

For those employer groups that renew their health insurance on January 1, 2023, the beginning of September is the time to start the review process. If you are a smaller employer, important questions to ask yourself are:

- How will my employees complete the application process?

- Could they use an online application program like Survey Methods, Google Forms, FormFire, or Easy Apps Online?

- When can employees start the process of completing their applications?

Some insurers allow for applications to be dated within 120 days of their renewal date. That means employees could begin the application process as early as September 1, 2022. If your employees are not filling out applications, now is the time to do a quick survey. Getting a pulse from your employees will help to determine what options you need to keep in place and what adjustments you need to make to the health and well-being package.

Cost of Benefits

Cost for the employer and the employee can be a major deciding factor. The type of program may provide discounts, returns of claim funds, or additional benefits. For example, chambers of commerce or associations may offer discounts or additional plan benefits for smaller businesses that can’t afford the discounts that larger organizations have access to. Some plans offer savings to employees for participating in wellness programs. These are all options that you should inquire about at your renewal.

The health insurance plan design you select is as important as the insurance company you choose to provide your benefits. Consider plans that may meet your employees’ immediate needs more readily, such as split-dollar co-payments for office visits, personal nurse benefits, or plans that offer telemedicine at no cost. Carefully review the prescription drug plans available to you, as well. Implementing a tiered deductible network, deductible for brand-name prescriptions, a $0 copayment for emergency room visits (subject to the deductible), or selecting a plan with higher copayments for brand-name drugs and specialty medications can all result in a reduction in premium. Bundling your ancillary benefits like dental, vision, life, LTD, and STD insurance may result in more favorable pricing and/or a multi-year rate guarantee without sacrificing quality.

Maintaining Compliance

Make time to review any compliance requirements. The DOL has a self-compliance tool for employers to use as a guide. Keep in mind the IRS updates guidelines as well, such as HSA contributions limits and the ACA affordability requirement. Therefore, before determining the contribution breakdown between you and your employees, do a quick calculation to ensure the amounts will be within the published guidelines.

There are a lot of factors to consider as you review your health and well-being offerings in your open enrollment process. Setting a timeline for a complete review will help keep the renewal process on track. Considering all your different options will ensure your employees receive the best possible benefits at the best possible price. Educating your employees on their new benefits will give them time to prepare. Wishing you well in this renewal season!

Thank you to Gina Kocevar with LS Benefits Group for contributing to this edition of our HR Question of the Week!

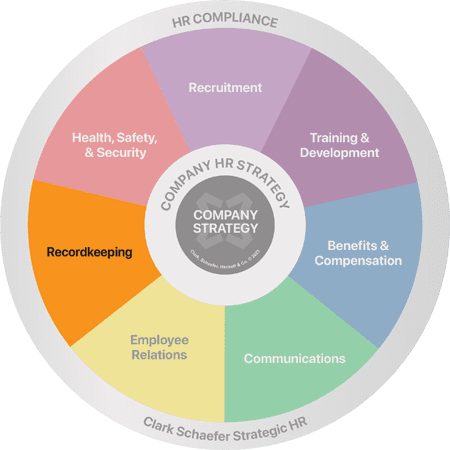

Clark Schaefer Strategic HR have the answers to all of your tough Benefits and Compensation related questions. Whether you need an analysis of your current benefit offerings or are looking to create a cost-effective recognition and rewards program, Strategic HR can do the job. Please visit our Benefits & Compensation page for more information.