What is HR’s Role in the Mergers & Acquisitions Process?

Last Updated on September 30, 2025 / HR Strategy

Mergers & Acquisitions (M&A) are a complicated process affecting every facet of an organization – most importantly, its people. Because employees are the key to ensuring the success of any organization, it is critical to develop a thoughtful and strategic human resources-focused approach in the M&A process. This requires HR leaders to be involved from the beginning. Forbes reminds us of several notable failed M&A attempts when employees were not factored into the process from the start. Through early and ongoing inclusion in the M&A evaluation, planning, and integration process, human resources can play an important role in strategic planning, change management, effective internal communication, and cultivating/transitioning culture.

HR’s Role in the Five Phases of M&A

We have found that most mergers and acquisitions include the following five phases, and we have identified how HR professionals can and should play a role in each phase to result in a successful merger.

Phase 1: M&A Evaluation

The first step in the M&A process is for the interested parties to start discussing the possible merger or acquisition. The name of the game here is discretion. Due to the sensitive nature of M&As and the data that will be shared, both parties will need to sign non-disclosure agreements (NDAs) to ensure that no information is leaked before the appropriate time.

These preliminary talks are often highly secretive because they may/may not lead to a merger, so there is no need to cause alarm. Although the level of confidentiality that’s needed can vary, its importance is heightened if either party is publicly traded. It’s critical for HR to be involved early to understand the HR landscape at a high level, including information such as the number of employees and managers, locations, whether or not a union will be involved, etc.

Phase 2: Third Party Engagement

Third parties help both the buyer and seller navigate the process. These third parties are usually lawyers, accountants, investment bankers, financial planners, business coaches, or M&A advisors. These individuals will be involved in the development of the structure and content of the legal agreement.

A merger or acquisition can happen quickly or take months. Although the timing varies, it is not too early for HR to start looking into what management changes need to take place when this deal closes, potential cultural problems, redundancy issues, and what key employees need to be retained. Having thought through these issues early in the process will improve the outcome.

Phase 3: Prep Time and Due Diligence

In this preparatory phase, HR should become even more involved. Initially, as an HR expert, you will want to get as much information as you can from the seller to begin your analysis. This information is usually provided in a secure data room and may be provided in general terms without any names, but it will give you an idea of the “HR side” of the organization. This could include:

- Leadership compensation

- Organization chart

- NDAs

- Employment agreements

- Payroll records

- Benefits that are offered, including 401k/retirement, compliance with ERISA, carriers for the plans, costs, last 2 years’ data

- Pending legal issues

- Financial documentation

At this point, the parties will sign a letter of intent signaling that they are all in agreement with the business framework for the deal. Now the due diligence begins. All documents are carefully reviewed by HR and finance to ensure that there are no unexpected surprises that could derail the deal.

Phase 4: The Agreement

In this phase, the finer details and price become the top focus. There are books written about how valuation is calculated in various industries, so we won’t go into that here. The most important thing is that both parties will come to an agreement on the price and legal documents will be drawn up. Be aware that negotiating the finer details of the acquisition may take longer than you would think.

Once the agreement is reached, there are some filings that need to be completed including with the secretary of state, tax documents, workers’ compensation, and other government bodies who will need to be notified of the event. At this point, the information will soon be public, and you should have a communication plan ready.

Once everything is signed, the integration of the two entities begins and management and HR must now bring the two workforces together.

Phase 5: Integration

HR is now tasked with ensuring the new company is fully integrated. The integration phase includes:

- Communication strategy

- Combining the organizations and cultures

- Determining redundancies

- Formulating strategy

- Ensuring the retention of staff

The “people” side of the acquisition is extremely critical at this point. HR must find ways to retain key employees and keep employees engaged.

How HR Can Ensure Successful Integration

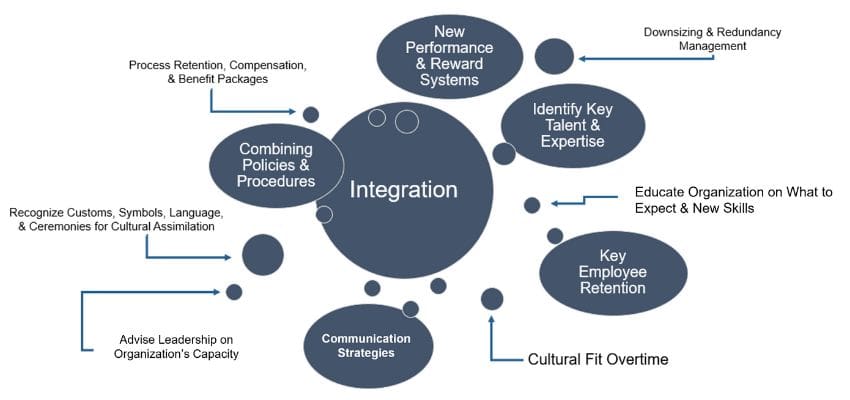

To weave together a new organization, HR will need to keep an eye on many different threads – first among those is culture. Cultural compatibility issues often arise when bringing together two or more organizations in the M&A process. The M&A integration always has a degree of misalignment, regardless of the perceived similarity between the two organizations. Cultural alignment has been identified as the top challenge in M&A transactions, therefore we recommend HR professionals be prepared to address it early on.

Additional areas of focus, as reflected in the diagram below, include combining policies and procedures, identifying and retaining key employees, conducting talent assessments, combining compensation and benefits, and implementing a well-developed communication strategy.

Identifying and Retaining Key Employees

Retention of key employees will be critical to the success of the M&A. To retain key talent that will help make the new organization successful, HR and/or management should communicate its intentions to the “star performers” as early in the process as is legally possible to help ensure retention. This will involve requesting access to conduct confidential interviews with key employees in advance of the actual closing date.

HR should advise management to be very careful not to under-commit to these key employees, or they will consider other employment options. Star performers know who they are and understand their personal and professional marketability.

Combining Policies and Procedures

HR will need to look at the policies of both organizations and consider how to handle the differences. You may choose to retain only the buyer’s or seller’s policies or combine the best pieces from both organizations. You will also need to determine how to handle any changes that would cause employees to have less than what they currently have (i.e., PTO, cell phone, etc.). In the end, you may decide to grandfather those items or provide compensation.

Conducting Talent Assessments

HR will need to identify and manage redundancies and reductions. Be prepared to allocate a significant amount of time to assess employee knowledge, skills, and abilities (KSAs) to determine which individuals will be retained and who will be let go. Your strategy may include terminations, early retirements, and a longer-term plan to simply not fill certain positions as they are vacated. A careful strategic approach will be key here. The ways in which these talent management decisions are made is as important as the actual decisions themselves. Ultimately, they communicate a great deal about the new organization’s values.

Tips on how to approach talent assessments:

Go through your organizational chart and identify key people. Don’t limit yourself. Consider everyone, not just management. For example, are there key people in your hourly staff?

For each key employee provide:

- A short summary of their main responsibilities

- Years of service, specific experience, and retention risk estimate

- Criticality of the role/employee for the continuation of business and operations

- Any specific agreements with the employee not included in the data provided (i.e., education, training, bonus, perks)

- Development ambition/potential for next steps or succession candidate for other roles within the company

- Other comments to be highlighted by management

You may find a 9-box tool to be helpful in this analysis.

Combining Compensation & Benefits

Depending on the circumstances of the deal – and the compensation policies of the combining companies – HR will likely be called on to splice disparate payment plans into a compensation program that fits the new organization.

It goes without saying that all employees, new and old, will be concerned about what is happening with their pay. Be sure to provide full and early disclosure about the changes being considered to put their minds to rest. Also, members of the senior management team will be anxious to see what types of special arrangements (i.e., stock options, special retirement provisions, severance agreements) will be offered to them given the high-profile nature of the new positions.

In addition to developing compensation programs, HR will likely be required to assess and make recommendations on employee benefits. You can follow a similar process to how you combined policies and procedures for the organization by retaining only the buyer’s or seller’s benefits or combining the best pieces from both organizations. You should also decide if there are any options for which you choose to grandfather in or compensate.

Similar to compensation, employees are sure to be concerned about possible changes to their employee benefits coverage and will want to be informed about “the new package” as soon as that information is available.

Implementing a Well-Developed Communication Strategy

Having a well-planned communication strategy in place is critical throughout the M&A process. It is important to control the message, delivery, and timing, especially when it comes to who gets the information first (i.e., employees, clients, media, investors). When preparing your communication strategy for employees, HR and company leaders should use a concise people-related strategy.

You should include:

- The shared vision for the new company

- The nature and progress of the integration and the anticipated benefits

- The outcomes and rough timelines for future decisions

- Compensation and benefits

- Key policies, rules, and guidelines to govern employee behavior and related workplace expectations (i.e., attendance, time off, harassment, drug testing, privacy, etc.)

Communicating clear, consistent, and up-to-date information not only will give employees from both organizations a sense of control by keeping them informed, but it also can increase the coping abilities of employees and minimize the impact of the integration on performance.

Five Tips for a Successful Communication Program:

- Establish multiple routes of communication (i.e., one-on-one meetings, group sessions, newsletters, intranet updates).

- Focus on the themes of change and progress by highlighting projects that are going well and action items that are being delivered on time.

- Repeat the common themes of the M&A to increase employee understanding of the rationale behind the transaction.

- Provide opportunities for employee involvement and feedback.

- Ensure that employees understand there will be problems, but give a commitment that the problems will be identified and addressed as early as possible.

The Importance of Transparency and Compassion

The success of your integration hinges on how your restructuring is implemented. As a result, the highest priority for the acquiring company is to be transparent and straightforward about what is happening and what is planned. Even when the news is bad, the one thing employees of newly acquired companies appreciate most is the truth. This includes being able to say “we don’t know” about certain areas or “we have not yet decided” about others. Being honest also includes sharing information about when and by what process a decision is expected to be reached.

Once decisions are made about functions and people, HR and company leaders must treat those employees who will be negatively affected by the transaction with dignity, respect, and support. Not only is this approach the humane thing to do, but it also is a powerful way to show those who remain what kind of company they are now working for and can help them to begin to develop positive feelings toward the new organization.

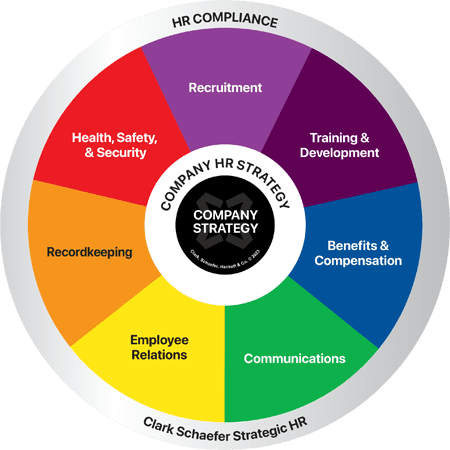

Ensuring that your HR Strategy aligns with your Company Strategy is critical to the success of your organization. Clark Schaefer Strategic HR (CSSHR) has years of experience helping clients develop and implement their HR strategy and goals. Visit our HR Strategy Services to learn more about how we can help to assess your organizational design and HR processes to effectively plan for the future.