What Are Unemployment Voluntary Contributions?

Last Updated on December 22, 2023 / HR Strategy

HR Question:

What are unemployment voluntary contributions? Can this benefit our company?

HR Answer:

Before we dive into voluntary contributions, let’s first address unemployment insurance. The US Department of Labor (DOL) explains that unemployment insurance is a federal-state program that is financed through federal and state employer payroll taxes. Typically, according to the DOL, employers must pay federal and state unemployment taxes if they pay wages to employees totaling $1,500 or more in any quarter of a calendar year, or if they had at least one employee during any day of a week during 20 weeks in a calendar year. It’s important to note that laws can vary among states, so you may want to check your state’s unemployment insurance requirements.

Employer unemployment voluntary contributions are financial contributions made by employers to their state unemployment insurance programs beyond their mandatory payroll taxes. These contributions are made voluntarily and are a way for employers to potentially reduce their unemployment tax rate.

By making these contributions, employers can help ensure that adequate funds are available to provide unemployment benefits to their employees if the need arises. While these contributions are typically not mandatory, they can be an important aspect of a comprehensive approach to workforce management and effectively managing the company’s budget.

How Unemployment Voluntary Contributions Function for Employers

First, you will need to confirm if your state allows unemployment tax voluntary contributions as not all states do. Employers considering voluntary contributions typically need to meet specific eligibility criteria set by the state unemployment insurance program. This may include factors such as the nature of the business and compliance with employment regulations.

If they meet the eligibility requirements, employers can choose to make voluntary contributions to the unemployment tax fund. These contributions are generally made to state government agencies responsible for managing unemployment benefits.

These contributions have the potential to influence an employer’s tax liability and, in some cases, result in reduced unemployment tax rates. This, in turn, can contribute to cost savings for the employer.

Advantages

Cost Savings: Making voluntary contributions can potentially lead to reduced unemployment tax rates for employers, resulting in cost savings over time.

Financial Predictability: Voluntary contributions offer employers the ability to plan and manage their finances more effectively as they can contribute based on their financial standing and business cycles.

Drawbacks

Financial Strain: While voluntary contributions can potentially lead to long-term savings, the upfront financial burden of making additional payments may pose challenges for some employers, especially smaller businesses with limited resources.

How To Decide What To Do

For employers, the decision to participate in unemployment tax voluntary contributions involves carefully weighing the potential benefits and drawbacks. While these contributions can result in cost savings and positive employee relations, they may also present financial challenges. Employers should assess their financial capacity and business needs before opting for voluntary contributions, ensuring that their decision aligns with their business and HR strategy.

Thank you to Marie Frey, SHRM-CP, HR Business Advisor, for contributing to this HR Question of the Week.

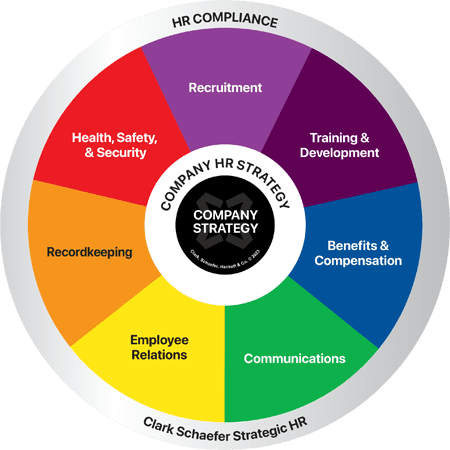

Ensuring that your HR Strategy aligns with your Company Strategy is critical to the success of your organization. Clark Schaefer Strategic HR has years of experience helping clients develop and implement their HR strategy and goals. Visit our HR Strategy Services to learn more about how we can help.