Key Areas of Recordkeeping to Keep Up to Date in the New Year

Last Updated on January 2, 2019 / Recordkeeping

Question:

As the new year begins, what specific tasks should I be thinking about to ensure we have our Recordkeeping up to date and accurate for the new year?

Answer:

Kudos to you for thinking proactively. As you close out last year and dive into the new year, there are a few key areas of Recordkeeping that you should take a look at to be sure you get a fresh start for the new year:

- Review your employee files!

- Is your filing caught up? Don’t let the pile continue into the new year. File it today!

- Have you removed terminated employee files from your active files?

- Randomly review a few employee files to ensure the right documents are being retained – nothing is missing and nothing needs removed. Depending on your findings, you may decide to audit all employee files.

- Audit your I-9 documents.

- Do you have one for every current employee?

- Are they completed accurately and in full?

- Have you separated your terminated employees from active?

- What I-9s can now be destroyed?

- Ask your employees to review their employee information!

- Do you have the most up to date mailing address to ensure timely distribution of W2s?

- Are their emergency contacts and contact information accurate?

- Any changes to their dependents’ information?

- Any changes needed for Federal and State tax allowances?

- Reconcile your employees’ Paid Time Off (vacation and sick days).

- Do your employees have time that will carry over into the new year?

- Is any time forfeited that was not used?

- Ensure up to date benefits information.

- Have you distributed new benefit cards (i.e. medical, dental, vision) to your employees?

- Do you have the right benefits information posted online or on bulletin boards as the new year begins?

- If you have Flexible Spending Accounts, remind employees of important deadlines to submit their FSA claims so they don’t lose money that’s been set aside.

- Is your employee salary information up to date with disability and life insurance policies?

- Review your employee handbook.

- Are there any policies that should be added or changed in your handbook?

- Update State and Federal Mandated Posters.

- Many states have new minimum wage requirements. Be sure your posters are displayed and showing up to date information.

- Create a calendar for the new year.

- Identify key requirements (i.e. W2 distribution, OSHA Logs, ACA Reporting, EEO-1 Reports)

- Note key events (i.e. performance review periods, merit increases)

- Plan your own development (i.e. conferences, events).

The list is not all inclusive, but it is meant to be a good starting point so you can add other things that you may think of to create your checklist.

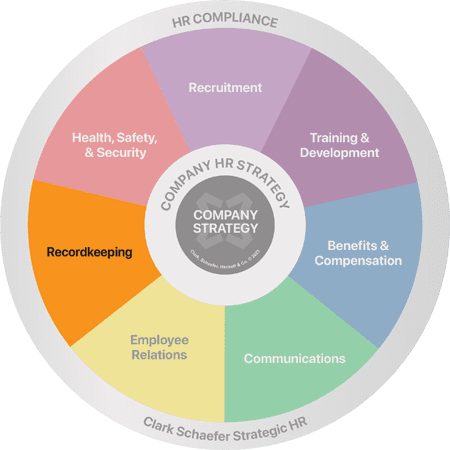

Have you taken Strategic HR’s HR Checkup to make sure you are ready? For more information on the HR Checkup, contact Robin at 513-697-9855 or robin@strategichrinc.com to learn more.