An Employee Died Suddenly But Had Not Updated Their Beneficiary

Last Updated on May 14, 2019 / Recordkeeping

Question:

We recently have had a long time employee with the company die suddenly. I have never had to handle death benefits before and learned that this employee did not update his beneficiary after his divorce and remarriage. His ex-wife is still listed as the beneficiary. His current wife is highly upset with me because of this. Is there something I can do to let our life insurance carrier know he was divorced and remarried so his current wife can get the benefit? Did I fail in my duties somehow by not having this updated?

Answer:

Assuming that this was against the deceased employee’s wishes, it is quite an unfortunate situation. As the employer, there is nothing you can do about a beneficiary form that has not been updated. Beneficiary forms are the responsibility of the employee and if an employee fails to complete one, update one, or completes it incorrectly, that is their responsibility, not yours. Some employees balk at making the change, indicating their will is up to date; however, employees should not assume that state law will revoke early beneficiary designations for company plans and allow a will to prevail. This is because in the instances of company health and welfare plans, the plans are governed by ERISA. The Employee Retirement Income Security Act dictates that the plan administrator of these plans must turn over the funds to the beneficiary listed on the forms, no matter if they were remarried or what is listed in the employee’s will. Many such instances have ended up in court but honestly, there is nothing the employer can do in these situations.

The Department of Labor issued a document for employers on best practices surrounding beneficiary designations in ERISA sponsored plans. Although the document is dated (2012), it still contains some best practices on maintaining beneficiary information. This may be helpful for you to help your employees to avoid future situations.

Any financial professional will tell you, it is essential for you to keep your beneficiary information on file and up to date, even for work provided benefits. This would include plans such as company paid life insurance, deferred compensation, and/or retirement accounts through an IRA, a 401(k), or a pension plan. It is essential for employers to have employees complete a beneficiary form for all of their accounts. Employers/benefit administrators typically have employees complete these forms upon eligibility but they are never mentioned again. Employers are encouraged to remind employees during the open enrollment process to make sure their beneficiaries are up to date. Marriage, Divorce, and Births occur during the employment cycle and many employees forget to update their beneficiary to reflect those changes. In addition, as a plan administrator, you must also remember to get updated beneficiary forms when you change providers. Many employers shop around for benefits and make carrier changes. It is essential that employees complete new beneficiary forms during such changes.

No one wants to deliver the news to a grieving spouse that the employee never updated their beneficiary. No, it is not an employer’s responsibility BUT if we see our job as assisting in the health and welfare of our employees, reminding them to update their beneficiary is an easy way to do that and to avoid such a situation.

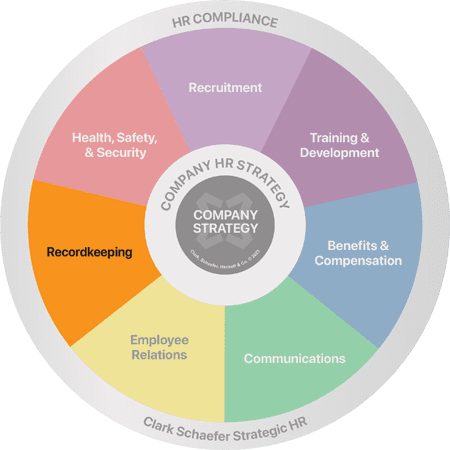

Employment recordkeeping does not rank high on the list of favorite human resources functions, and is one of the more mundane tasks associated with Human Resources. However, it is extremely important and can get you into hot water if not done properly. Keeping appropriate recruiting and hiring documentation is vital to proving, if needed, your employment processes are compliant. Strategic HR has a great online tool that’s affordable, easily downloaded and ready for immediate use. Another one of our resources is our Recordkeeping Desktop Reference which has everything you need in regards to recordkeeping requirements mandated by law. Avoid the fines and minimize your stress level by having Strategic HR assist with your recordkeeping compliance. Visit our Recordkeeping page to learn more about our services.