When Does An Employee’s I-9 Form Need Updated?

Last Updated on February 9, 2022 / Recordkeeping

HR Question:

I have an employee who was recently married and changed her name. Does she need to complete a new I-9 form with her new name?

HR Answer:

When an employee changes their name (legally) employers are not required to complete a new I-9 form. The US Citizenship and Immigration Services recommends that employers note the name change in Section 3 of the form. To make sure your records are in order, here are the points to consider:

- It is not necessary to document the new forms of identification but most employers, for payroll purposes (not for the I-9 form), will require a copy of the new social security card.

- It is important for employers to make sure payments are made to the legal name on an individual’s social security card to ensure their W-2 is correct and there are no mismatches.

- For purposes of the I-9 form, an employer must make a reasonable attempt to ensure the name change is appropriate by requesting a copy of a marriage license or a divorce decree or even a letter from the employee’s religious representative if necessary.

If you have more questions concerning I-9 forms, visit the U.S. Citizenship and Immigration Services (USCIS) Employers Handbook for completing Form I-9.

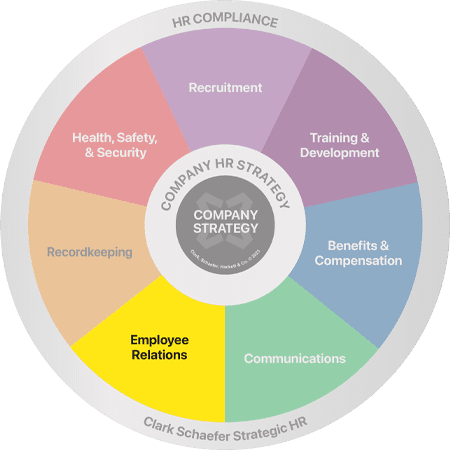

Employment recordkeeping does not rank high on the list of favorite human resources functions, but it is vitally important. Take the I-9 Form for example. Failure to complete this form on a new employee could result in a series of fines. Avoid the fines and minimize your stress level by having Strategic HR assist with your recordkeeping compliance. Visit our Recordkeeping page to learn more about our services.