Electronic Pay Stubs

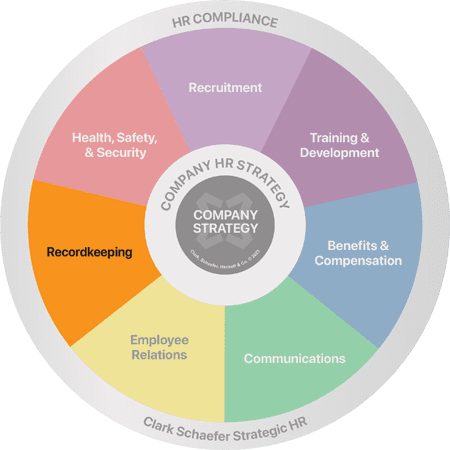

Last Updated on December 5, 2016 / Recordkeeping

Question:

How to be legally smart when providing electronic pay stubs to employees when their checks are direct-deposited?

Answer:

Many companies are switching over to paperless solutions for payroll for a variety of reasons; cost reductions, employee requests, time savings, and more. This may seem like an easy solution, and it can be. However, there are different laws that employers should be aware of when it comes to providing these electronically.

On a federal level, employers are not required to provide pay statements. However, many states (41) require that employers provide employees with this statement of earnings…and each state is different in how and what needs to be included. When it comes to electronic pay stubs, only a few states have addressed electronic delivery. It appears that every state allows electronic paystubs as long as certain conditions are met…the most important being that the employee has the ability to print the pay stub on their own. Some other states require “opting-in” to the program.

In summary, electronic pay stubs are permitted, but must comply with state law mandates. Each state’s laws are different, so the best option is to check your individual state’s laws and your payroll provider to ensure compliance.

Recordkeeping is full of “if this, then that” situations. You will often hear us say “it depends” when asking about personnel files and recordkeeping. Keep the guesswork out of keeping your files in order and up-to-date. Strategic HR has a handy desktop reference ready to guide you on the documents you can keep together in an employee file and how long you need to keep them. Visit our HR Store to request a copy of our Recordkeeping reference.