How do I manage compensation increases with inflation?

Last Updated on August 29, 2023 / Benefits & Compensation

HR Question:

How do I best manage compensation increases with inflation still rising?

HR Answer:

This is a question many companies continue to wrestle with as the US economy experiences rising inflation. According to the Bureau of Labor Statistics (BLS), the consumer price index (CPI) reached its highest annual increase (8.6%) in over 40 years in May 2022, and we continue to watch the CPI on the rise. These increased daily costs put significant pressure on employees to stretch their income further, which in turn, puts pressure on employers to increase wages to cover the gap.

Employers also need to consider other factors when assessing pay strategies, such as the state of the labor market. With employment rates at record lows, it can be harder to find and attract qualified candidates, making salary a sticking point in many employment conversations.

What does this mean for organizations as they try to meet the needs of employees and remain competitive in the market? How are they supposed to be competitive when navigating rising costs across the board? What if salaries have already increased – should they be expected to continue to climb so soon? We recommend the following considerations to help manage your compensation increases amidst inflation and a tight labor market.

Keep Inflation In Mind When Strategizing

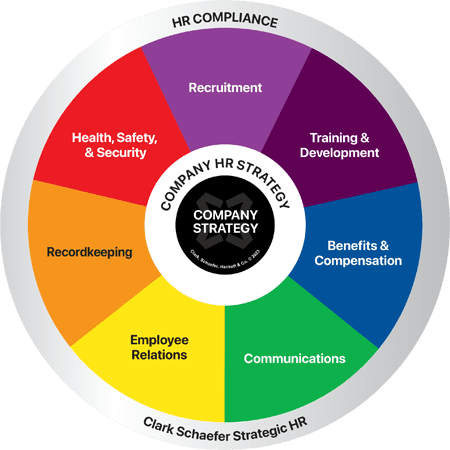

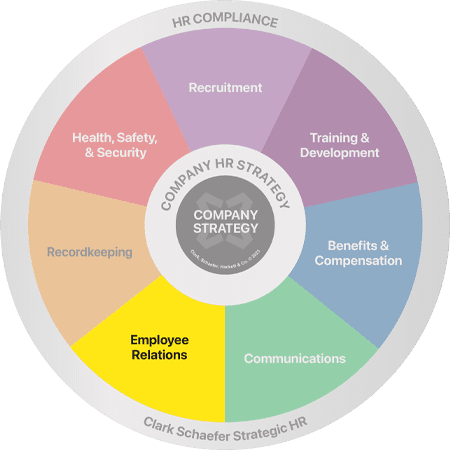

With these external influences, HR leaders need an effective rewards strategy that retains current high performers, attracts top candidates, evaluates business costs, and is applied equitably. Easy, right? Not only that, but the approach should align with organizational strategy, have market-based salary data, include review processes, and consider non-monetary compensation. Then, that complex plan should be communicated throughout the organization.

This presents an opportunity to ensure that your annual compensation review process includes an assessment of how the cost of living impacts your pay strategy. Consider adding inflation into your review model utilizing data from the Department of Labor and additional government agencies, along with the criteria you use to determine annual pay increases. While you don’t have to directly increase your salary rates in step with the inflation percentage, not doing so may put your organization at a competitive disadvantage in the candidate market.

Salary Benchmarking

Rather than relying on inflation to exclusively guide your salary increases, consider utilizing salary benchmarking tools for each role in your company. This is also a great opportunity to weave in any feedback you’ve learned from job candidates, stay interviews, or exit interviews. The compensation review process could then use current market-based salary ranges to recommend increases.

And, while it makes sense to consider what’s happening in the economy, an increase in the cost of living may or may not lead to a proportional pay increase. Although prices may be going up, it doesn’t mean that compensation market data has moved at the same rate as inflation. For example, if the CPI has increased by 8%, salaries may have increased by less than 8% or more than 8% in the market. This is why conducting salary benchmarking is crucial for each position.

Benchmarking against what other organizations are planning for salary increases can help give a sense of perspective as well. According to a recent survey conducted by WorldatWork, increases in 2024 are budgeted for 4%. You may want to review several resources to compare compensation data across your industry for a reasonable comparison.

Non-Monetary Compensation

Take-home pay is the predominant concern when inflation hits, but other variables can still be vitally important to employees. Evaluate benefits and non-monetary rewards offered and consider additional low-cost options.

For example, are there ways to enhance health benefit subsidies, HSA contributions, flexibility, paid time-off, retirement contributions, tuition reimbursement, etc.? Providing more generous offerings in this category could help ease the impact of inflation without necessarily increasing your immediate costs.

Communication and Transparency

Before finalizing compensation increases, collaborate with other leaders to determine the overall economic impacts on the organization. Perhaps additional revenue streams or other increased costs may impact the feasibility of compensation increases either way.

Once decisions have been made, effectively communicating with employees is crucial. Tailor the message based on the employee’s perspective and make sure to be transparent and empathetic while explaining the reality of what is and isn’t possible. Doing this authentically will help people feel valued.

Compensation analysis is an ongoing process, and HR Leaders should consistently evaluate the organizational strategy and market data to stay competitive. With a robust strategy, sound framework, and effective communication, any factor can be considered and incorporated appropriately.

Thank you to Becky Foster, Sr. HR Business Strategist, for contributing to this HR Question of the Week.

Let the HR Business Advisors at Strategic HR review your strategy and conduct a compensation market analysis to make sure you’re not missing any opportunities to have a rewards strategy that attracts, retains, and engages your team. Learn more about our Benefits and Compensation Services or Contact Us for help.