Exemption Status of Inside Sales

Question:

How do you handle the exemption status for Inside Sales employees?

Answer:

According to the Fair Labor Standards Act (FLSA), Outside Sales employees are exempt while Inside Sales employees are non-exempt. (http://www.flsa.com/coverage.html).

To help define inside versus outside sales roles, we researched the Department of Labor (DOL) website. The DOL defines outside sales employees as those that sell their employer’s products, services, or facilities to customers away from their employer’s place(s) of business, in general, either at the customer’s place of business or by selling door-to-door at the customer’s home. Sales made from the employer’s location (inside sales) do not qualify as outside sales. Similarly, work done by mail, telephone or the Internet do not qualify as outside sales unless such activities are in connection with sales made by personal contact. Some employees performing inside sales work in certain retail establishments may be exempt from the overtime pay protections under FLSA section 7(i) – http://www.dol.gov/elaws/esa/flsa/overtime/s1.htm.

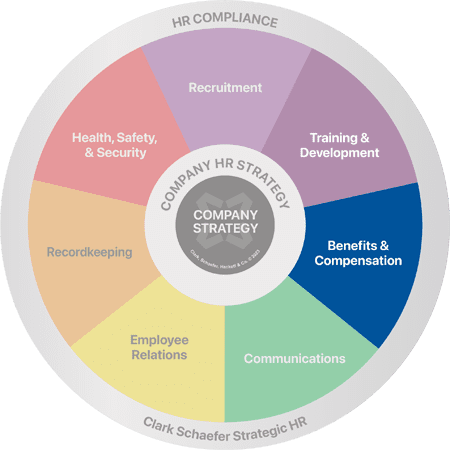

Strategic HR has the answers to all of your tough Benefits and Compensation related questions. Whether you need an audit of your exemption statuses or a job analysis of your positions, Strategic HR can do the job. Please visit our Benefits & Compensation page for more information.