Voluntary Classification Settlement Program

Last Updated on November 28, 2017 / Benefits & Compensation, HR Compliance

Question:

What is the new Voluntary Classification Settlement Program (VCSP) and what, if anything, does my company need to do?

Answer:

The new Voluntary Classification Settlement Program (VCSP) was developed by the IRS to provide payroll tax relief to employers that reclassify their workers (as employees) for future tax periods. Part of the Fresh Start initiative created by the IRS, this program aims to increase compliance and reduce the tax burden for employers. Under the VCSP employers will pay 10 percent of the employment taxes that would have been due for the most recent tax year on the workers being reclassified. Employers also avoid interest and penalties on the payment and will not undergo an audit for tax purposes in prior years.

To take part employees in question must have previously been treated as independent contractors or other non-employees. Employers need to file an application with the IRS at least 60 days before beginning the treatment of these workers as employees. Employers will be notified whether or not they are eligible to participate and in doing so, the IRS will not share the reclassification with the Department of Labor.

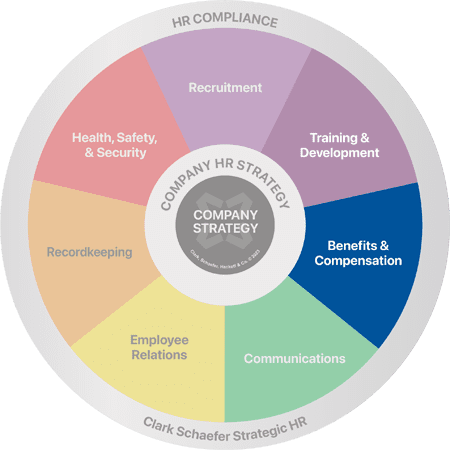

It’s never ending. Just when you thought you had a handle on recent regulatory changes something new crops up. There isn’t enough time in the day to keep on top of everything! That’s where Strategic HR can help. We stay on top of the changes so you don’t have to. Ask us for assistance with any of your benefits, compensation or other regulatory needs. Please visit our Benefits & Compensation page for more information on any of these services.