How to Conduct an I-9 Audit and Correct Form I-9 Mistakes

HR Question:

I’m doing an internal audit of our I-9 Forms, and I want to make sure I’m doing it right. So far, I’ve run into some problems. Some forms are incomplete, I don’t have an I-9 for all employees, and I think that a document provided for one of them is fake. What should I do when I find Form I-9 mistakes?

HR Answer:

There aren’t always easy answers for how to handle situations that arise during internal I-9 audits. There is a lot of information to be captured, and there are portions on the I-9 forms that are easily missed. However, conducting regular audits of your I-9 forms and correcting them appropriately can significantly reduce financial and legal risks and keep you in compliance. We will share recommendations to help you through an I-9 audit and the correction process when you discover Form I-9 mistakes.

What to look for during an Internal I-9 Audit

As you review your I-9 Forms, it’s important to know what a fully completed form looks like. You should ensure the following in your review:

- The information on the form is clear, legible, and easy to read.

- The Employee section (section 1) is completely filled out either prior to the start date (but after an offer of employment has been made) or on the first day of employment. Ensure that the employee has dated and signed section 1.

- The Employer section (section 2) is filled out within 3 days of the employee starting.

- Documents are listed in appropriate sections (Either A only or B and C).

- Date of hire is completed in the Certification section at the bottom of the form and matches the date in the payroll records.

- Signature, date, and address of the company has been completed.

- Highlighting marks, hole punches and staples do not interfere with an authorized official’s ability to read the information on the form.

- Copies of the documentation retained with Form I-9 are legible if copies of documentation are made.

- Abbreviations used are widely understood. Do not use an abbreviation that is not widely known.

- All applicable sections of the form are completed.

- The current version of the Form I-9 is used. To determine whether you are using the correct version of Form I-9, look at the revision date printed on the bottom left corner of the form, and not the expiration date printed at the top of the form. For your convenience, here is a link to the current version of the Form I-9.

- The English version of the form should be completed unless the form is being completed in Puerto Rico. The Spanish version is approved for use only in Puerto Rico.

How to Make I-9 Corrections

If you come across Form I-9 mistakes, the USCIS (United States Citizenship and Immigration Services) has the following recommendations in making corrections:

Employers may only correct mistakes made in Section 2 or Section 3 of Form I-9, Employment Eligibility Verification. If you discover a mistake in the Employee section (section 1), you should ask your employee to make the correction.

To correct the Form I-9:

- Draw a line through the incorrect information.

- Enter the correct information.

- Initial and date the correction.

To correct multiple recording errors on the form, you may redo the section on a new Form I-9 and attach it to the old form. A new Form I-9 can also be completed if major errors need to be corrected, such as entire sections being left blank or Section 2 being completed based on unacceptable documents. A note should be included in the file regarding the reason you made changes to an existing Form I-9 or completed a new Form I-9.

If you discover a document that clearly looks fraudulent, or like it does not identify the correct individual, you should talk with the employee about it and ask them to provide alternate documentation from the list of acceptable documents.

On the other hand, if you only find a copy of a document that is hard to read, unclear, or confusing to you, no action may be required. The US Immigration and Customs Enforcement (ICE) guidance related to internal I-9 audits specifically states that an employer “should recognize that it may not be able to definitively determine the genuineness of Form I-9 documentation based on photocopies of the documentation. An employer should not request documentation from an employee solely because photocopies of documents are unclear.”

Rest assured – there are a number of resources available to help you with completing the Form I-9 correctly, and by conducting internal audits, you can make sure there are no Form I-9 mistakes. The U.S. Immigration Customs and Enforcement and the Immigrant and Employee Rights Section (IER) have provided joint guidance to help employers perform internal audits. Learn more about Guidance for Employers Conducting Internal Employment Eligibility Verification Form I-9 Audits.

The USCIS also has an “I-9 Central” section of their website. You can find in-depth information on how to complete the form, make corrections, review descriptions of acceptable documents, and much more.

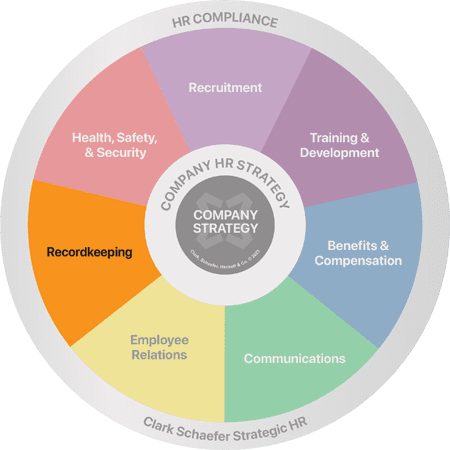

Employment recordkeeping does not rank high on the list of favorite human resources functions, but it is vitally important. Take the I-9 Form for example. Failure to complete this form on a new employee could result in a series of fines. Avoid the fines and minimize your stress level by having Strategic HR assist with your recordkeeping compliance. Visit our HR Compliance & Recordkeeping Services to learn more, or Contact Us today.