Can I backdate FMLA paperwork?

Question:

Can I backdate FMLA paperwork to the date at which the employee went on Workers’ Compensation?

Answer:

In a word, “no” – FMLA cannot be backdated. That’s why it is so critical that HR is on top of any types of absences that may qualify for FMLA. If an injury that falls under Workers’ Compensation also qualifies as a “serious medical condition” under the Family and Medical Leave Act, any time missed can be counted against the 12 week leave allotment an FMLA qualified employee is entitled to receive. When such an event occurs, send the appropriate notifications (found on www.dol.gov), and make sure you document that you have done so. Then follow up appropriately for the certifications. The clock does not start ticking on FMLA until the notifications have been sent – whether it is immediately after the incident, or two months later. Keep in mind, if an employee returns to work on light duty, from a Workers’ Comp injury, that is no longer time counted against Family Medical Leave.

The world of employee leave is a complex one, often involving Family Medical Leave, Workers’ Compensation and the Americans with Disabilities Act. Many times, the different types of leaves overlap. Make sure you consider all appropriate legislation when an employee is absent from work before taking any type of adverse employment action.

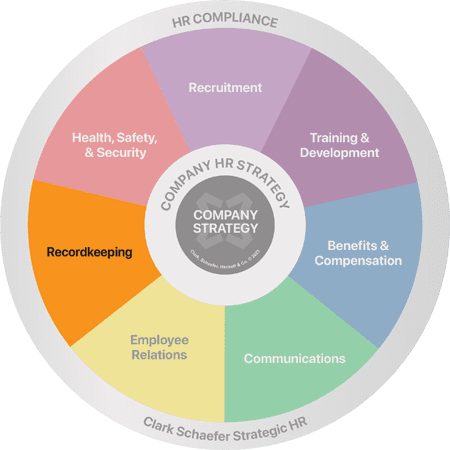

FMLA, the ADAAA and other labor laws can be difficult to interpret, let alone enforce. That’s where Strategic HR has you covered. We bring years of experience and know-how to the table. We can assist you with your tough compliance issues and help you sleep more soundly at night. Visit our Compliance page to learn more.